Our Financial Management Courses

Financial Management: NATED N4 National Certificate

Financial Management: NATED N5 National Certificate

Financial Management: NATED N6 National Certificate

Financial Management: NATED N6 National Diploma

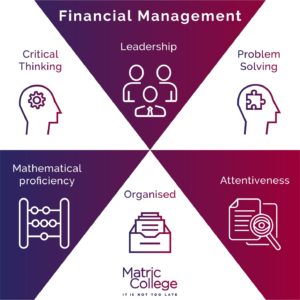

Financial Management Courses are courses that help students become successful in the world of Finance. These courses will equip you with the basic skills of Financial Management. In this course, students can:

- Understand the basics of Financial Accounting

- Gain entrepreneurial skills

- Learn the importance of communicating with staff and clients professionally

How do you know if these courses are the right choice for you? If you answer “yes” to 3 or more of the questions below, then you should consider completing one of our Financial Management Courses.

- Do you like working with numbers?

- Are you good at Mathematics?

- Did you have Mathematics or Mathematical Literacy as a subject in school?

- Do you like working in an office environment?

- Are you an organised person?

Our partnership with Bellview Institute of Distance Learning allows us to offer NATED courses.

What Are Financial Management Courses?

These are courses that help students understand how to manage their own business or their employer’s business finances.

Financial Management: NATED N4 National Certificate

SAQA ID: 66874

Course Credits: 60

NQF Level: 5

Qualification Title: N4 Financial Management

Qualification Type: National N Certificate

Course Duration: 6 – 12 months

Entry Requirements

- Be 16 or older

- Have a Matric Certificate or National Senior Certificate or Amended Senior Certificate

- Understand, read and write English

- Study through distance learning

Course Subjects

The Financial Management: NATED N4 National Certificate will consist of the following subjects:

- Entrepreneurship and Business Management

Learn how to write a business plan. By examining all aspects of entrepreneurship, you will learn all about starting your own business.

- Financial Accounting

The objective of this subject is to teach you how to analyse and report financial transactions.

- Management Communication / Bestuurskomunikasie

Learn how to effectively communicate in a managerial environment.

- Computerised Financial Systems

You will learn the basics of Pastel Accounting and Pastel Payroll in this subject.

Complete Subject List

- Financial Accounting N4

- Computerised Financial Systems N4

- Entrepreneurship and Business Management N4

- Management Communication N4

Financial Management: NATED N5 National Certificate

SAQA ID: 66954

Course Credits: 60

NQF Level: 5

Qualification Title: N5 Financial Management

Qualification Type: National N Certificate

Course Duration: 6 – 12 months

Entry Requirements

- You have to complete and pass the previous course which is the N4 Financial Management Course

- Have a Matric Certificate, National Senior Certificate or Amended Senior Certificate

- Understand, read and write English

- Study through distance learning

Course Subjects

Here is a list of all of the subjects that are offered for the Financial Management: NATED N5 National Certificate.

- Financial Accounting

In this subject, you will learn how to analyse and report financial transactions.

- Cost and Management Accounting

During this subject, you will learn how to manage, control, and eliminate expenses in a business. In addition, you will learn how to improve the profitability of a business.

- Entrepreneurship and Business Management

Learn how to create a business plan. By examining all aspects of entrepreneurship, you will learn everything you need to know about starting your own company.

- Computerised Financial Systems

In this subject, you will learn the basics of Pastel Accounting and Pastel Payroll.

Complete Subject List

- Financial Accounting N5

- Cost and Management Accounting N5

- Entrepreneurship and Business Management N5

- Computerised Financial Systems N5

- Mercantile Law N4

- Mercantile Law N5

- Economics N5

- Economics N4

Compulsory Subjects

- Financial Accounting N5

- Computerised Financial Systems N5

- Entrepreneurship and Business Management N5

- Cost & Management Accounting N5

Financial Management: NATED N6 National Certificate

SAQA ID: 66998

Course Credits: 60

NQF Level: 5

Qualification Title: N6 Financial Management

Qualification Type: National N Certificate

Course Duration: 6 – 12 months

Entry Requirements

- You have to complete and pass the previous course which is the Financial Management: NATED N5 National Certificate

- Have a Matric Certificate, National Senior Certificate or Amended Senior Certificate

- Understand, read and write English

- Study through distance learning

Course Subjects

Four (4) subjects make up the Financial Management NATED N6 National Certificate. Here is what you will learn in each subject:

- Financial Accounting

In this subject, you will learn how to analyse and report financial transactions.

- Cost and Management Accounting

During this subject, you will learn how to manage, control, and eliminate expenses in a business. In addition, you will learn how to improve the profitability of a business.

- Entrepreneurship and Business Management

Learn how to create a business plan. By examining all aspects of entrepreneurship, you will learn everything you need to know about starting your own company.

- Computerised Financial Systems

In this subject, you will learn the basics of Pastel Accounting and Pastel Payroll.

Complete Subject List:

- Financial Accounting N6

- Computerised Financial Systems N6

- Entrepreneurship and Business Management N6

- Cost & Management Accounting N6

Financial Management: N6 National Diploma

SAQA ID: 67040

Course Credits: 360

NQF Level: 6

Qualification Title: N6 National Diploma

Qualification Type: National N Diploma

Course Duration: 18 months

Entry Requirements

To gain entry into this course, you have to complete and pass the previous theoretical courses which are:

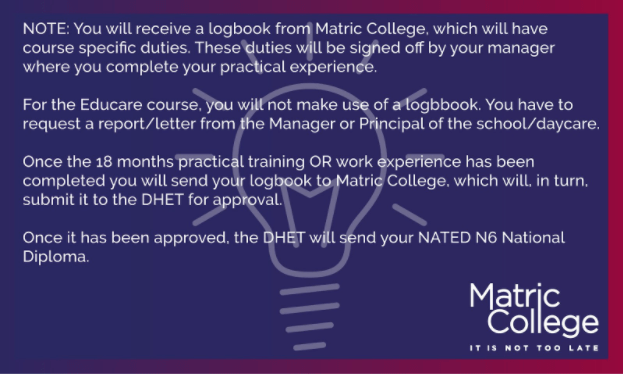

This “course” only consists of 18 months of work experience and no theoretical component.

Course Subjects

This course does not consist of any theoretical component which means you will not have to complete any subjects. You will only complete your 18 months of work experience.

It can take between 6 – 12 months to complete one NATED Course. To complete the entire NATED Programme (N4, N5, N6 National Certificates and N6 National Diploma) takes between 18 – 36 months to complete. Here is a table of the different ways you can complete the NATED programme.

6 Months – Complete One NATED LevelIf you only complete the theoretical component of the course, you can complete it between 6 – 12 months.

|

12 Months – Complete Two NATED LevelIf you only complete the theoretical component of these courses, you can complete it between 12 – 24 months.

|

18 Months – complete Three NATED LevelIf you only complete the theoretical component of these courses, you can complete it between 18 – 24 months.

|

The main subjects for the NATED Financial Programme are:

- Financial Accounting

- Computerised Financial Systems

- Cost and Management Accounting

The three subjects appear throughout the entire NATED Financial Management Programme. These subjects help students become successful in the Financial field of study.

Yes, Finance does have a lot of Math. Although Finance deals with a lot of Mathematics, the majority of the Math is fairly basic. You must be comfortable working with numbers to examine and interpret figures gathered from data.

Financial Management N4 – N6 courses are the National Qualifications (NATED) that were designed by the Department of Higher Education and Training. Each course has a theoretical and practical component that should be completed to get a NATED National Diploma.

These courses start with an NQF Level 5 and move up to an NQF Level 6. An NQF Level 6 qualification is just one level below a Degree Qualification.

National Qualifications are also referred to as NATED courses. It stands for National Accredited Technical Education Diploma courses. National Qualifications (NATED Courses) build on one another. This means that you must complete the N4 National Certificate course to gain entry into the N5 National Certificate.

If you would like to enter the world of finance, you can complete any of our Financial Management N4 to N6 courses.

You can do the following with a Financial Management: NATED N6 Certificate:

Find Employment: Entry-Level Jobs

You can find entry-level employment with your Financial Management NATED N6 National Certificate. Here are the positions you can apply for:

- Accounting Clerk

- Creditors Clerk

- Financial Clerk

- Financial Manager

- Junior Financial Assistant

- Payroll Administrator

Further Your Studies At Matric College

You can further your studies at Matric College. We offer more courses in our NATED Financial Management Course. Here are the other courses we offer:

You can do the following with your Financial Management: NATED N6 National Diploma:

Find Employment: Entry-Level Jobs

With your Financial Management N6 National Diploma, you can find employment. Here are some positions you could apply for:

- Accounting Clerk

- Creditors Clerk

- Financial Clerk

- Financial Manager

- Junior Financial Assistant

- Payroll Administrator

Further Your Studies At Matric College

You can continue your studies at Matric College. In addition, we offer ICB Financial Accounting Programmes that are internationally recognised and you can study these courses without a Matric Certificate. The Institute of Certified Bookkeepers (ICB) is an Independent External Examination Board that offers accredited Business courses.

Here are all of the ICB Financial Accounting Courses that we offer:

An N6 National Certificate has 60 credits. Once you have completed your 18 months of work experience you will receive your N6 National Diploma.

The N6 National Diploma has 360 credits. This is a combination of all of the N National Certificates (N4 – 60 credits), (N5 – 60 credits), (N6 – 60 credits) and the 18 months of practical experience which is 180 credits.

- N4 National Certificate has 60 credits

- N5 National Certificate has 60 credits

- N6 National Certificate has 60 credits

- N6 National Diploma has 180 credits

In total: This is 360 credits

No, the Financial Management course is not difficult. While you will find that taking any course at first is challenging, the more you learn about it, the easier it becomes. Keep the following considerations in mind:

- Choose a Financial Management course to learn more about numbers

- Choose a Financial Management course if you enjoy Math

- Choose a Financial Management course if you are willing to put in the time and effort

Yes, Financial Management is a good career. This is why it is important to take a Financial Management course:

- Financial Managers are critical to every business

- By getting more insight into your own and your business’s finances, you can make better financial decisions

- The skills you learn are transferable, which means you can use your skill in every industry that you choose to work in

- Financial Management is a scarce skill in South Africa, once you are qualified, employers will easily employ you because they need people with your skills

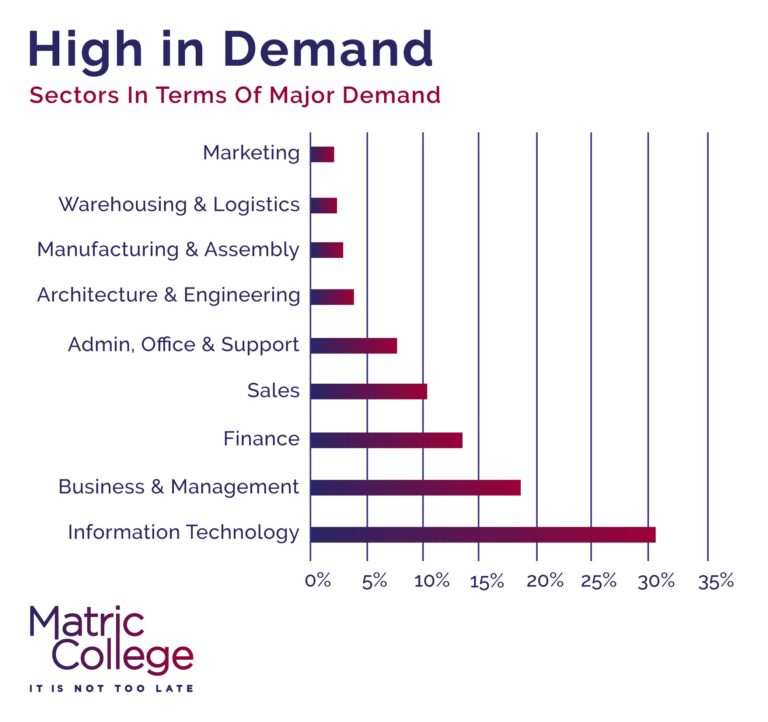

Yes, Financial Management is in-demand in South Africa. In South Africa, Financial Management is considered a scarce skill. Employers are looking for people who have skills and qualifications in Financial Management.

This opens up many doors for you and you can work in many different industries that are not related to Finance. For example, you can use your skills learned in the Financial Management course and apply them when you start your own hair salon business.

Here are some factors that contribute to the demand for a Financial Management course:

- The quality of the Financial Management Qualification

- The demand that each company needs a Financial Manager to run the finances of their business

- The knowledge and skills to successfully manage and increase business profits

Finance has been placed under the faculty of law, commerce and Management. It is the science of managing money. It involves two major activities:

- Managing money by businesses (corporate finance), governments (public finance), and individuals (personal finance);

- The process of obtaining the funds necessary to operate a business

Both courses are great career options. The best course can be determined by the following factors:

- Which course do I qualify for?

- Which field of study do I enjoy the most?

- How long do I want to study?

- What can I afford?

- What study methods do I enjoy?

Which Course Do I Qualify For?

It is always a good idea to complete a course that you qualify for. To qualify for a course you need to look at the following factors:

- Do I need a Matric Certificate?

- Apply with a Grade 10 Certificate for our ICB Programmes

- Apply with a Matric Certificate OR Bridging course: Junior Bookkeeping: ICB National Certificate

- Can I apply at any age?

- Apply for any of our courses at the age of 16 or older

- Is there a due date for registration?

- Apply any time of the year at Matric College

- Which Field Of Study Do I Enjoy The Most?

You can choose which field of study you enjoy the most. Whether you want to complete a Bookkeeping course OR an Accounting course. Ultimately, you make the decisions based on your personal preferences.

How Long Do I Want To Study?

This depends on the time you choose to spend studying a course. Here are the factors that can influence the duration of the course you choose:

- If you want to complete a course fast

- If you need to complete a course for your current place of employment

- If you have the time to complete a longer course

What Can I Afford?

This is the amount you are willing to pay for a course as well as what you can afford at the moment. At Matric College you can work and study, we also offer payment plans. You can contact our course experts for more information.

What Study Methods Do I Enjoy?

If you do not have the time to attend physical classes then distance learning is the perfect study method for you. At Matric College you choose when to study, submit assignments and write the exams.

In both fields of study, you can earn a decent salary. Your salary will be determined by your position.

R 25 000 Per month

The average salary for a Finance Manager is R 25 000 per month in South Africa.

Source: talent.com

The salary will be determined by the following factors:

- How much experience you have

- The education you have received

- The position you have applied for

- The employer’s expectations

Bookkeeping: ICB National Certificate

SAQA ID: 58375

Course Credits: 120

NQF Level: 3

Qualification Title: Junior Bookkeeping

Qualification Type: National Certificate

Course Duration: 12 – 16 months

Entry Requirements

- Have a Grade 10 Certificate

- Be at least 16 or older

- Be comfortable studying through distance learning

Course Subjects

You only have to complete 4 subjects for this qualification. Here is what you will learn in each subject:

- Bookkeeping to Trial Balance

In this subject, you will learn how to calculate debit and credit accounts and how to balance them.

- Payroll and Monthly SARS Returns

You will learn how to calculate SARS returns and process payroll payments in this subject.

- Computerised Bookkeeping

You will learn how to calculate and file financial data using a computer.

- Business Literacy

You will learn how to communicate professionally in a business environment

Bookkeeping: ICB FET Certificate

SAQA ID: 58376

Course Credits: 130

NQF Level: 4

Qualification Title: Senior Bookkeeping

Qualification Type: ICB National Certificate

Course Duration: 12- 24 months

Entry Requirements

- Have completed the previous course which is the Bookkeeping: ICB National Certificate

- Understand, read, write English

- Be comfortable learning through distance learning

Course Subjects

You only need to complete two subjects for the Bookkeeping: ICB FET Certificate course. Keep in mind that you must complete and pass the previous course subjects.

- Financial Statements

In this subject, you will learn how to prepare financial records for a company.

- Cost and Management Accounting

You will learn how to manage and reduce the costs of a company while increasing its profits.

Completion of all subjects required for the National Certificate in Bookkeeping

Complete these subjects first:

- Bookkeeping to Trial Balance

- Payroll and Monthly SARS Returns

- Computerised Bookkeeping

- Business Literacy

Subjects to be covered for ICB Bookkeeping FET Certification

Then complete these subjects:

- Financial Statements

- Cost and Management Accounting

Technical Financial Accounting: ICB National Diploma

SAQA ID: 36213

Course Credits: 251

NQF Level: 5

Qualification Title: Technical Financial Accounting

Qualification Type: ICB National Diploma

Course Duration: 12 – 24 months

Entry Requirements

- You have to complete the previous course, which is the Bookkeeping: ICB FET Certificate course

- Understand, read and write English

- Study through distance learning

Course Subjects

You only have to complete two subjects for the Technical Financial Accounting: ICB National Diploma course. Keep in mind that you have to complete and pass the previous course subjects.

- Income Tax Returns

You will learn how to complete monthly SARS returns and gain knowledge of Tax processes in this course.

- Business Law and Accounting Control

The purpose of the subject is to teach you how to run a business in compliance with the law and regulations of commercial duties.

The subjects for ICB Bookkeeping FET Certificate must be completed

First, complete these subjects

- Financial Statements

- Cost and Management Accounting

The complete list of subjects for the ICB Technical Financial Accounting National Diploma

Then complete these subjects

- Income Tax Returns

- Business Law and Accounting Control

Certified Financial Accounting: ICB National Diploma

SAQA ID: 20366

Course Credits: 280

NQF Level: 6

Qualification Title: Certified Financial Accounting

Qualification Type: ICB National Diploma

Course Duration: 12-36 months

Entry Requirements

- You have to complete the previous course, which is the Technical Financial Accounting: ICB National Diploma course

- Understand, read and write English

- Study through distance learning

Course Subjects

You only have to complete four subjects for the Certified Financial Accounting: ICB National Diploma course. Keep in mind that you have to complete and pass the previous course subjects.

- Corporate Strategy

In this subject, you will learn how to think of new ideas to improve the company you are working for and the plans of a company and its future business activities, It could also be the process of deciding these ideas and plans within a company.

- Management Accounting Control Systems

You will learn how global information systems is collected, processed, analysed and communicated. With this information, you can plan, monitor and control different businesses.

- Financial Reporting and Regulatory Frameworks

You will learn about recent trends and emerging issues, such as corporate governance, social disclosures, environmental issues, interim reporting and segment reporting, etc.

- Research Theory and Practice (in the short dissertation; topic: financial accounting)

This is your thesis, you will choose a topic related to financial accounting and research it extensively.

The list of subjects for ICB Technical Financial Accounting National Diploma

First, complete these subjects:

- Income Tax Returns

- Business Law and Accounting Control

This is the complete list for the Certified Financial Accounting: ICB National Diploma course

Then complete these subjects:

- Corporate Strategy

- Management Accounting Control Systems

- Financial Reporting and Regulatory Frameworks

- Research Theory and Practice (in the short dissertation; topic: financial accounting)

An ICB Qualification is designed by the ICB to create pathways for students to obtain affordable credible business courses. Here are the three Programmes offered by Matric College:

- Financial Accounting (apply with a Grade 10 Certificate)

- Business Management (apply with a Grade 11 Certificate OR the ICB Bridging course)

- Office Administration (apply with a Matric OR Matric Equivalent Certificate OR the ICB Bridging course)

Yes, ICB Courses are recognised nationally and internationally. Read below to find out more.

Yes, all of ICB’s qualifications are recognised in South Africa and they are registered on South Africa’s National Qualifications Framework (NQF).

The National Qualifications Framework (NQF) is a set of nationally agreed guidelines and principles that are used to measure and record educational achievements across all provinces and sectors in South Africa, including the finance sector. Here is a table with all the ICB Qualifications and their NQF Levels:

| Qualification | NQF Level |

| General Certificate: ABET Level 4 / Grade 9 | 1 |

| Elementary Certificate: Grade 10 | 2 |

| Intermediate certificate: Grade 11 | 3 |

| National Certificate: Senior Certificate (Amended) / National Senior Certificate / National Senior Certificate for Adults / Matric Equivalent Certificates | 4 |

| Higher Certificate | 5 |

| Diploma & Advanced Certificate | 6 |

| Bachelor’s Degree & Advanced Diploma | 7 |

| Honours Degree & Postgraduate Diploma | 8 |

| Masters Degree | 9 |

| Doctoral Degree | 10 |

Here is where you should go after completing your ICB studies:

- Get employed

- Further your studies with ICB in the same programme

- Further your studies with ICB in another programme

- Further your studies at a university

Get Employed

The first step for most ICB students is to find employment. You can get employed after you have completed any of our ICB courses. Our ICB courses are recognised and accredited.

Further Your Studies With ICB In The Same Programme

If you have just started your educational journey with ICB and started with the first course, you can then move on to the next course.

For example, complete the Certified Financial Accounting: ICB National Diploma course. This course comes after the Technical Financial Accounting: ICB National Diploma.

Further Your Studies With ICB In Another Programme

You are not only limited to the Financial Accounting Programme. You can also further your studies in another Programme. Here are the other Programmes you can study at Matric College:

- ICB Business Management

- ICB Office Administration

NOTE: Some of the Programmes have the same subjects. This means that you do not have to complete the subjects again if you have decided to change Programmes.

Below is a list of the different streams and their subjects. Take a look at how similar the subjects are.

We have here highlighted only the National Diploma courses for all three Programmes as an example. The student we are focusing on is completing an ICB Financial Accounting Programme.

It is worth noting that some of the subjects in the ICB Financial Accounting Programme are the same as those in the other two Programmes (ICB Business Management and ICB Office Administration).

| ICB Office Administration | ICB Business Management | ICB Financial Accounting |

| First Course (Certificate) | ||

| Business and Office Administration 1 | Business Management 1 | Bookkeeping To Trial Balance |

| Bookkeeping To Trial Balance | Bookkeeping to Trial Balance | Payroll and Monthly SARS Returns |

| Business Literacy | Business Literacy | Computerised Bookkeeping |

| Marketing Management and Public Relations | Business Literacy | |

| Business Law and Administrative Practice | ||

| Cost and Management Accounting | ||

| Second Course (Higher Certificate) | ||

| Business And Office Administration 2 | Office and Legal Practice | Financial Statements |

| Human Resources Management and Labour Relations | Business Management 2 | Cost and Management Accounting |

| Economics | Marketing Management and Public Relations | |

| Financial Statements | ||

| Human Resources Management and Labour Relations | ||

| Third Course (Diploma) | ||

| Business and Office Administration 3 | Business Management 3 | Income Tax Returns |

| Financial Statements | Financial Management and Control | Business Law and Accounting Control |

| Management | ||

| Fourth Course (Diploma) | ||

| Corporate Strategy | ||

| Management Accounting Control Systems | ||

| Financial Reporting and Regulatory Frameworks | ||

| Research Theory and Practice | ||

Refer back to the highlighted areas above. If you want to complete the ICB Business Management: National Diploma Programme, you only need to complete the 7 subjects that are not highlighted.

There are also 8 subjects that are not highlighted in the ICB Office Administration Programme. If you complete these 8 subjects, you will receive your ICB Office Administration: National Diploma.

Yes, you may apply for credits based on previous studies or work experience with ICB. This process is called Recognition of Prior Learning (RPL) and recognises work experience and study qualifications completed within 5 years of starting an ICB Course or Programme.

Credits for work experience are earned by completing a competency exam, while credits for previous studies are awarded if the qualification is recognised on the National Qualifications Framework (NQF) and has a South African Qualifications Authority (SAQA) ID.

It Is Important To Note That Credit Exemptions Are Not Guaranteed.

No, a Diploma in Accounting does not make you an Accountant. It does, however, make you a qualified Bookkeeper or Assistant Accountant. You could also get other positions in the Finance industry. You can move in the direction of an Accountant if you decide to further your studies. A Diploma in Accounting can be the stepping stone to becoming an Accountant.

Do some research before applying to universities because each university has different entry requirements and each course has different entry requirements.

Your options with a Diploma in Accounting are endless. For example, you can become a Loan Officer with a Diploma in Accounting or a Bank Teller.

Yes, you can study finance without Maths as a subject in High School. You can apply for any of our NATED Financial Management courses or ICB Financial Accounting courses with any Matric Pass Level.

- Corporate Finance

- Financial Institutions

- Investments

Corporate Finance

In corporate finance, the focus is on the sources of funding, the capital structure of corporations, the actions that managers take to enhance the value of the firm, and the tools and analysis used to allocate financial resources.

Financial Institutions

A financial institution sometimes referred to as a bank, is a business entity that serves as an agent for monetary financial transactions.

Investments

Investing is the act of dedicating an asset to achieving an increase in value over time. An investment requires the sacrifice of some present asset, such as time, money, or effort. Investing in finance is about generating a return on the invested asset.

Yes, a Bookkeeping Certificate is worth it for many students. A Bookkeeping Certificate can lead you down one of two paths:

- Qualify you for a job at an entry-level company

- If you are an Accountant, you can use it to further your career as one

You can ease into the field of accounting with a Bookkeeping Certificate. After acquiring a Degree, a Certificate can be used to gain specialised training.

There will always be a need for Accounting, which makes it a scarce skill. Money and financial data management is an essential part of managing a business, organisation, or non-profit. Maintaining accurate records, adhering to tax regulations, and making strategic financial decisions are all essential.

The Accounting profession is vital for these roles. The economy directly affects the growth of this field, since every business needs an Accountant. The demand for Accountants will continue to grow with the economy.

Furthermore, as businesses continue to become more globalised, specialised Accountants will be sought out for their knowledge of international trade, mergers, and acquisitions.

Yes, Bookkeepers are in demand. In fact, this is considered a scarce skill qualification. This means that employers want people who have these qualifications because they play an important role in their business.

The best Bookkeeping Certificate is determined by the following factors:

- How long do you want to study?

- What do you qualify for?

- Which field do you want to go into?

Here is a list of all of the ICB Bookkeeping Certificates that we offer:

Generally, Bookkeepers learn the profession’s fundamentals between 6 to 12 months of educational training.

The path you take to becoming a bookkeeper depends on your education and training. A lot of Bookkeepers earn undergraduate Degrees: employers often prefer candidates with college training.

However, for some employers, higher education is not a necessary Bookkeeping Qualification. In some cases, relevant experience and accounting knowledge may carry more value than educational background.

Here are the steps you can take:

- Complete High School: National Senior Certificate OR Senior Certificate (Amended)

- You can apply for our ICB Bookkeeping courses with a Grade 10 certificate

- Take Courses or Complete a Certificate: Learn bookkeeping independently or formally through courses and tutorials. You can also enrol in Certificate Programmes through distance learning colleges.

- Obtain an internship or training placement: Some employers will train Bookkeepers on the job through internships or placement programmes. Once you become qualified, you can find a permanent job or work as a Bookkeeper.

Yes, you can teach yourself Finance through the use of resources on the internet but it is best if you consider completing a formal qualification. At Matric College, you can work and study because we are a distance learning institution. This means that you do not have to attend any physical or scheduled online classes.

There are three types of Financial Management required by a company:

- Capital Budget Management

- Capital Structure Management

- Working Capital Management

Capital Budget Management

It is the process that companies use to decide if their assets (new machinery, new research projects) are worthwhile for the company to allocate funds towards. A financial team or Financial Manager decides where, when, and how the money should be spent.

Capital Structure Management

Capital structure management focuses on preserving the ongoing operations of businesses and maintaining flexible access to capital markets.

Working Capital Management

It is when the company uses bookkeeping processes and accounting strategies to keep track of current assets and liabilities.

Typically, Bachelor’s Degrees take four years to complete, while Master’s Degrees usually take two years. You can shorten the length of your Degree if you have any transfer credits, prior training, or certifications.

Our Accreditation

SAQA

SAQA stands for South African Quality Assurance. SAQA’s primary responsibility is to ensure the implementation of the National Qualifications Framework (NQF). All of our Financial Management Courses have a SAQA ID number. This is an indication that our courses are recognised on the NQF. To make sure that our courses are accredited, you can use the SAQA ID numbers provided and place them in the SAQA search engine.

DHET

DHET stands for the Department of Higher Education and Training. In the South African government, it is one of the educational departments. DHET oversees universities and post-secondary education. Our NATED exams are administered by the DHET, which means that the courses are accredited and recognised by employers.

ICB

ICB stands for the Institute of Certified Bookkeepers. ICB is an Independent External Examination Body that provides credible Business courses. ICB does not offer study material but they have over 500 registered training providers that do offer their courses. Matric College is registered with ICB; all of our ICB Courses are registered with ICB as well. This means that all of our ICB courses are accredited.

QCTO

Quality Council for Trades and Occupations (QCTO) mission is to effectively and efficiently manage the Occupational Qualifications Sub-Framework (OQSF). This is for everyone that is looking to complete a trade or occupation, to develop and certify national occupational qualifications, and, if appropriate, to develop and certify vocational skills. Our ICB Courses are accredited by the QCTO.

Why Choose To Study Financial Management Via Distance Learning

Here is why you should study Matric via distance learning:

- Study at your own pace

- Study a scarce skill qualification

- Make a payment that works for you

- Study and work

Study At Your Own Pace

We are a distance learning institution which means that you can study at any time. There are no fixed assignment deadlines. As long as you submit your assignments before you have to register for the examination.

NATED Courses: You have to complete and pass three assignments with an average of 40% to gain entrance to the final examination. The registration date for the final exam is in:

- February: Register for the exam between the 1st – 28th of February. You will write this exam in May / June.

- August: Register for the exam between the 1st – 31st of August. You will write this exam in October / November.

NOTE: This applies to each subject, which means you will have three assignments for each subject and a final exam for each subject. You can complete all of the assignments for every subject and then apply for the final exam. Alternatively, you can spread out the subjects because you have two examination options. You have to pass the final exam with an average of 50%

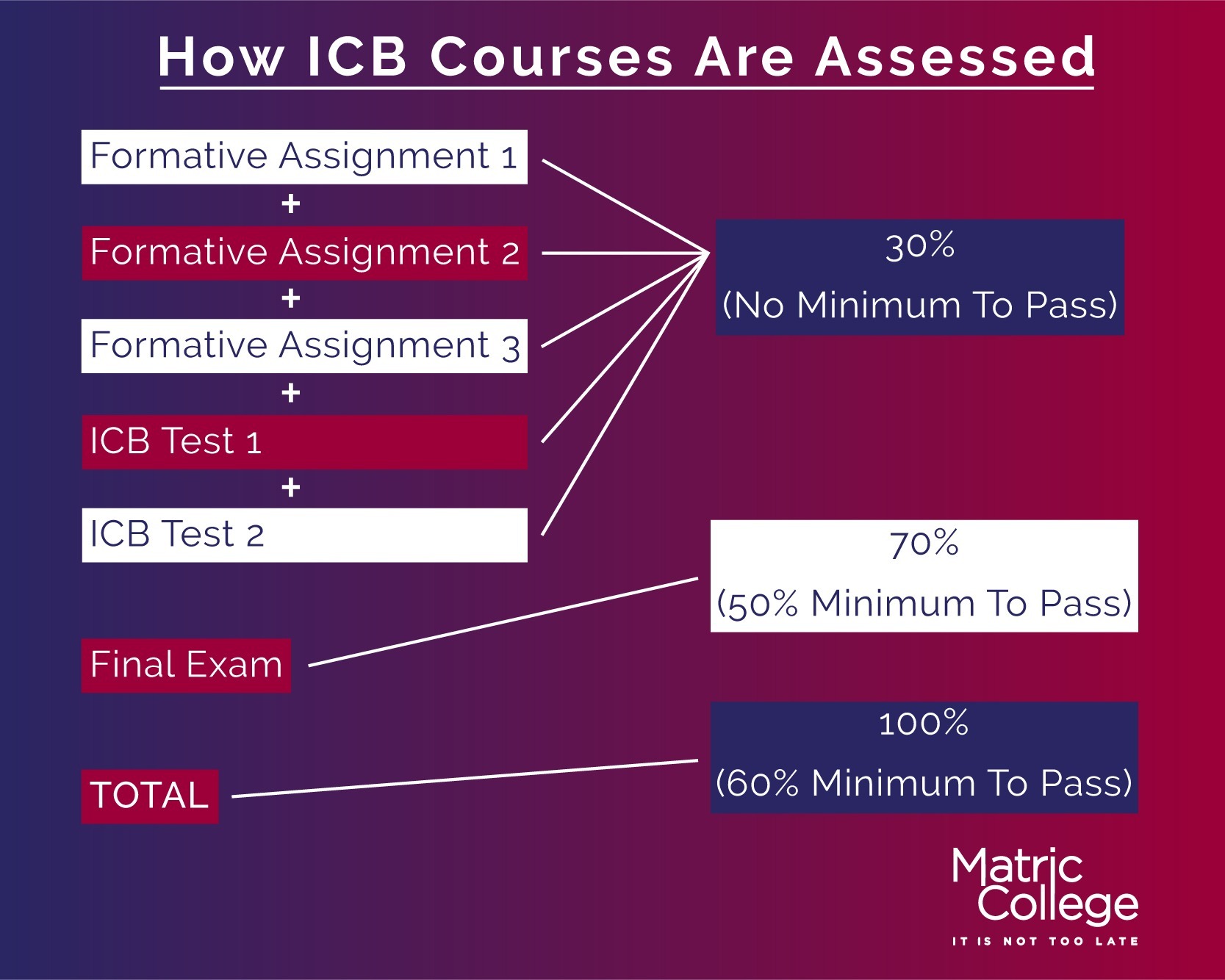

ICB Courses: Your Portfolio of Evidence (PoE) is what determines whether or not you are prepared for the exams. There are three formative assignments and two tests in the PoE. To take the exams, you must complete the PoE. You can write the exam every three months which means you have many opportunities to pass the exams. There are two types of ICB exams:

Students have these options available because ICB is aware that each student has different preferences, and also because of COVID protocols. This urged their decision to go online with their exams. Online Exams Online exams are an excellent option for students who prefer to study from home, but they are not limited to distance learners only. This option is also available for face-to-face students, but they will have to check with their College before taking the online tests. Online exams are between 01:00 pm – 04:30 pm. Distance learning students may apply and pay for exam registration through the ICB Student Portal. Face-to-face students can apply via their College. Paper-based Exams Paper-based exams are written at a specific location and are completed at a certain time. Distance learning students can also book these exams online. Paper-based exams are between 09:00 am – 12:30 pm. Distance learning students can apply and pay for the exam registration on the ICB Student Portal. Face-to-face students can apply via their College. |  |

NOTE:

As a result of COVID-19 protocols, the ICB venues (paper-based exams) can only accommodate a limited number of students. Make sure to book your paper-based exam in advance.

Also NOTE:

Exams and/or venues can be cancelled or withdrawn at any time by the ICB. ICB acceptance into any exam booking does not guarantee an exam sitting. If an exam is cancelled, students will be offered an alternative exam date.

Study A Scarce Skill

The Financial qualifications are one of the many scarce skill qualifications that we have in South Africa. It is in demand because employers need people with these skills. Students who complete Financial Management or Financial Accounting courses stand a chance to earn a decent salary and become highly employable.

Make A Payment That Works For You

At Matric College, we encourage students to voice their opinions on a payment plan that is unique to them. Here are the different payment plans that we have:

- Advance payments: This payment option allows you to pay your studies in full

- Split payments: This payment option allows you to pay half of the total amount at the beginning of the year and the other half, at the end of the year

- Monthly payments: This payment option allows you to pay a fixed instalment every month

- Unique payment method: This payment option allows you to find a payment method that works for both of us. You will discuss this with one of our supportive and friendly course experts

Work And Study

As a distance learning college, we use online tools such as email and WhatsApp to communicate with our students. All of our courses are completed through distance learning. This allows you to work and study because you will not attend any physical classes or attend any online scheduled classes. You will submit your assignments through email for our NATED Courses and through the ICB Student Portal for our ICB Courses.

Career Opportunities With A Financial Management Qualification

Here is a list of careers you can pursue with our NATED Financial Management Qualifications:

- Accounts Clerk – R 12 500 per month

- Administrative Clerk – R 12 500 per month

- Bank Teller – R 13 250 per month

- Loan Consultant – R 13 750 per month

- Finance Administrator – R 13 750 per month

Account Clerks maintain creditor and debtor accounts, perform related routine documentation, and calculate and investigate the costs of labour, materials, overheads, and other operating costs.

Responsibilities

- Updating financial records,

- Preparing financial reports

- Resolving bank statements

An Administrative Clerk is responsible for general office clerical work, including customer service, basic word processing, data entry, filing and organising.

Responsibilities

- Welcome clients and visitors and answer their questions

- Assist and support the sales and marketing teams

- Assist the accounts department with “accounting” tasks

- Prepare and verify invoices and payment records

- Organise and manage office filing systems effectively

In most banks, bank tellers are entry-level positions interacting with and serving customers directly. For those who show promise, a career as a Bank Teller can lead to becoming a Loan Consultant or Personal Banker.

Responsibilities

- Answers questions in person or by phone and refers customers to other bank services as required

- Keeps a record of currency and cash and turns in any excess cash or important information to the head teller

- Keeping a clean, organised work area and maintaining a professional appearance

- Providing information about bank products and services to customers

A loan consultant assists clients in making mortgage and loan decisions. They also approve or recommend loans to individuals and businesses. Typically, Loan Consultants work for commercial banks, credit unions, mortgage companies, and other financial institutions.

Responsibilities

- Contacting people to find out if they need a loan,

- Meeting with applicants and explaining their loan options

- In addition, they analyse an applicants’ financial information and decide whether to offer them a loan

Financial Administrators are responsible for the overall financial management. It includes budgeting and monitoring project expenses and the financial operations of a business.

Responsibilities

- Using office software to keep accurate financial records

- Preparing and auditing accounts (checking and investigating) accounts

- Creating monthly, quarterly or annual budget reports

- Activities related to payroll (staff wages), invoices, expenses, petty cash, and VAT

- Keeping track of bank accounts and matching payments

Here is a list of careers you can pursue with our ICB Financial Accounting Qualifications:

- Financial Manager – R 25 000 per month

- Assistant Accountant – R 15 433 per month

- Bookkeeper – R 15 000 per month

- Payroll Clerk – R 13 250 per month

- Technical Financial Accountant – R 21 044 per month

A Financial Manager analyses data and assists Senior Financial Managers on ways to maximize profits. Financial Managers are responsible for monitoring the business’ finances.

Responsibilities

- They are responsible for creating financial reports,

- Managing investment activities

- Developing long-term financial goals for their own business or their employer’s

Assistants Accountants provide administrative support to Accountants. Under the direction of the firm’s Accountants, an Assistant Accountant performs write-up tasks (bookkeeping).

Responsibilities

- Completing clerical tasks such as typing, filing, and making phone calls

- Basic bookkeeping and handling of mail

- Preparation of financial reports

- Calculating and checking to make sure that payments, amounts, and records are correct

Bookkeepers are often called bookkeeping clerks as well. Bookkeepers are generally in charge of some or all of a business’s accounts, which is called general ledgers.

Responsibilities

- Completing data entry

- Collect transactions

- Maintain and monitor financial records

- They record every transaction and post debits (costs) and credits (incomes)

- In addition, they prepare financial statements and other reports for supervisors and managers

Typically, Payroll Clerks work in human resources and/or accounting departments. They ensure that employees are paid accurately and on time.

Responsibilities

- Managing salaries through the use of payroll software

- Verifying and collecting the times that employees spend on duty

- Calculating the salary according to the hours employees have spent

- Calculating bonuses and commissions where necessary

- Respond to employee and management questions and complaints regarding payments

- Investigate and resolve errors in payroll

- Prepare and submit payroll reports to supervisors

A Technical Financial Accountant is a finance professional who performs various aspects of the accounting function, usually under the supervision of a Senior Accountant. He / She also assists a Senior Accountant, Auditor, or Financial Manager with accounting and financial management tasks.

Responsibilities

- Documenting financial transactions

- Compiling financial reports and statements

- Receiving and paying invoices

- The process of filing tax returns

- Providing assistance with audits

Benefits Of Studying At Matric College

We offer excellent opportunities for students who are interested in distance learning. Distance learning is an alternative to attending a class in person or taking online classes. Busy students will benefit from distance learning. Below are some reasons to study with us:

- We offer unique payment plans

- You can study and work

- Set up your own study schedule

- Get tutor assistance from us

- Our friendly support team checks in on your progress

Yes, people who have Finance Degrees do pay well because they have a scarce skill qualification.

No, Finance is not a useless degree.

BCom Financial Management is a Bachelor of Commerce in Financial Management. It is an undergraduate degree programme that prepares students to manage monetary resources in a business.

You do not need a degree to become a Financial Manager, you can study any of our NATED Financial Management or ICB Financial Accounting courses to become a Financial Manager.

You can become an Accountant by completing a degree course at university.

No, it is not hard to get a job in Finance. With a finance qualification, you can find a job easily because the finance industry needs your skills.

Financial Managers can travel a lot but this depends on the employers of the company. Some employers expect their Financial Managers to meet with national and international clients.

You can begin your career in Finance by completing a Finance course and then applying for an internship or junior position at a bank or an accounting firm, or in the finance department of a large company. The experience you gain from this type of work will help you in advancing your career in the field of financial management.

Author: Jesmé Africa

Editor: Amy Venter

Date Published: March 18, 2022

Download a brochure

Complete the form below to access your brochure download.

"*" indicates required fields