Certified Financial Accounting: ICB National Diploma is the final Qualification in the 4-course ICB Financial Accounting Programme.

| Certificate Type | National Diploma |

| Awarded By | FASSET |

| Award Type | FET Certificate and a Programme Completion Certificate |

| NQF Level | Level 6 |

| SAQA ID | 20366 |

| Credits | 280 |

| Entry Requirements |

Certified Financial Accounting: ICB National Diploma - Subjects

To study for the Certified Financial Accounting: ICB National Diploma you must have successfully completed the Technical Financial Accounting: National Diploma. Here are the subjects that you will study:

- Corporate Strategy (CRPS)

- Management Accounting Control Systems (MACS)

- Financial Reporting and Regulatory Frameworks (FRRF)

- Research Theory and Practice (RTAP)

Completion of Subjects In Technical Financial Accounting: ICB National Diploma

These are the subjects that you will have completed in the Technical Financial Accounting: ICB National Diploma before you study for the Certifed Financial Accounting; ICB National Diploma:

- Income Tax Returns (ITRT)

- Business Law and Accounting Control (BLAC)

Career Opportunities

Here are some of your career opportunities on completion of your Certified Financial Accounting: ICB National Diploma:

- Financial Accountant

- Tax Practitioner

- Tax Consultant

- Management Accountant

- Assistant Manager

- Accounting Officer

What Will I Learn?

On completion of your Certified Financial Accounting: ICB National Diploma, you will be able to:

- Compile annual financial statements

- Register with the Southern African Institute for Business Accountants (SAIBA)

- Work with Chartered Accountants

- Work with Auditors

- Strategise at corporate level

- Meet the International Financial Reporting Standards (IFRS)

Certified Financial Accounting: ICB National Diploma Assessments

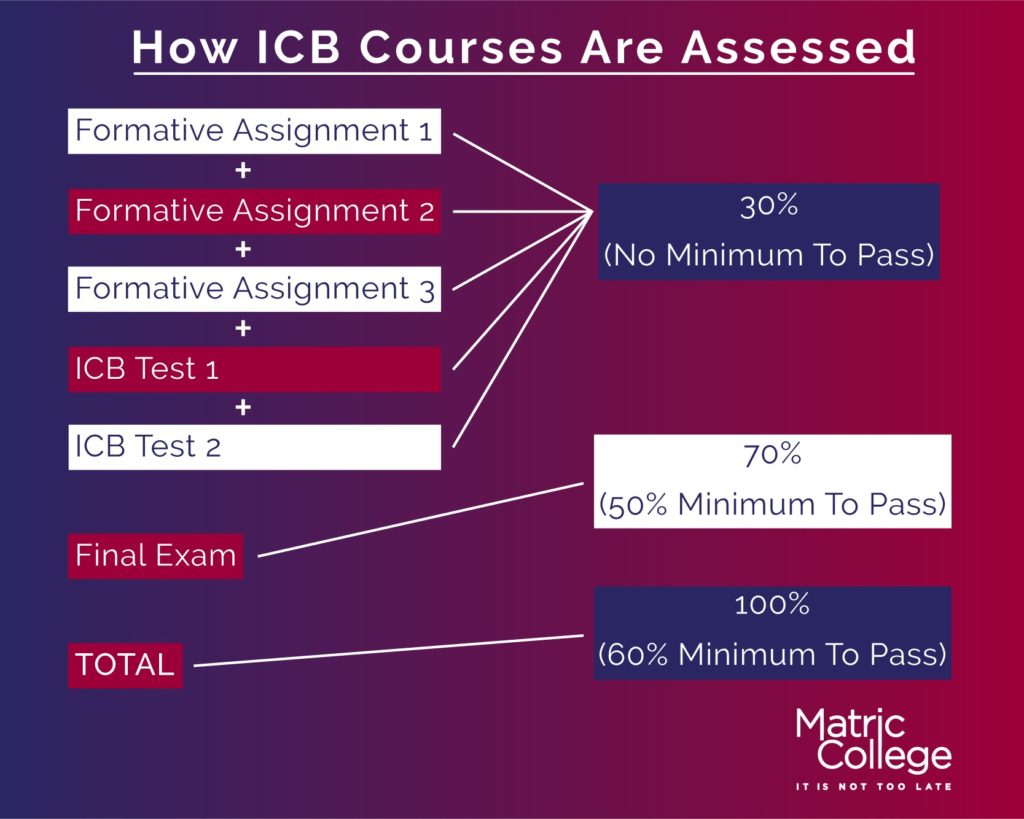

ICB uses Portfolios of Evidence to conduct student assessments. During your studies, you will add assignments and tests to your Portfolio of Evidence (PoE). You will complete three assignments and two tests before you write your final exam.

Portfolio of Evidence

The Portfolio of Evidence is accessed through the ICB MACCI platform. MACCI is the online portal used by ICB students to access their Portfolio of Evidence. Your login details on the platform will be provided as soon as you register for your exams.

Exams

Here is how you qualify to write the exams

- Completion of all the formative assessments, that is, the three assignments and the two online tests is a requirement.

- Submission of the Portfolio of Evidence online before the start of an exam is also a requirement. For the paper-based exam candidates, the Portfolio of Evidence must be submitted at least 48 hours before the exams.

Online Exams

The 3-hour online exams are written every other month from February. Exams start at 01:00 pm. You get 30 minutes to set up your computer. You will write your final exams on the MACCI platform. You will need to keep an eye on the ICB website for the actual dates.

Paper-Based Exams

These are exams written at an exam centre. Paper-based exams are written in March and August. The 3-hour exam starts at 09:00 am. Keep an eye on the ICB website for the actual dates.

Yes, ICB Qualifications are recognised nationally and internationally.

Nationally

ICB courses are recognised by professional bodies locally as their qualifications meet the requirements for their membership. Here are professional bodies that recognise ICB Qualifications:

- SAIT – South African Institute of Tax Practitioners

- SAIBA – Southern African Institute Of Business Accountants

Internationally

ICB Qualifications are also recognised by international professional bodies for either membership and/or exemption. Here are the international bodies that recognise ICB Qualifications:

- ACCA – Association of Chartered Certified Accountants – UK

- CIMA – Chartered Institute of Management Accountants – UK

- IAB – International Association of Bookkeepers – UK

- IAAP – International Association of Accounting Professionals – UK

Yes, Financial Accounting is a good career. Here is why you should complete a Financial Accounting course:

- Financial Accounting skills and knowledge are in demand

- Financial Accounting is a scarce skill

- Competitive Salary

- You gain transferable skills

To gain entry into the ICB Financial Accounting Programme, which leads to the Certified Financial Accounting: ICB National Diploma, here are the minimum entry requirements that you need:

- Grade 10 or Grade 10 Equivalent Certificate

- Ability to study in English

- Ability to study via distance learning

- Be at least 16 years or older

Remember ICB courses build on each other. This means that you can not skip any of the streams unless you get an exemption. Here is how you will progress to become a Certified Financial Accountant:

Junior Bookkeeper ⇒ Senior Bookkeeper ⇒ Accounting Technician ⇒ Certified Financial Accountant

Every organisation needs a Financial Accountant. Without a Financial Accountant, it is not possible to determine whether a business is making a profit or a loss. It is also not possible to determine how much money is coming into the business and how much is being spent. Here are some of the duties of a Financial Accountant:

- Preparing the monthly profit and loss report

- Preparing balance sheet reports

- Paying relevant taxes

- Collecting and analysing financial data

- Advising on estimates for project funding

- Controlling expenditure and cash flow

- Assisting with the preparation of year-end accounts

- Conducting internal audits

- Examining financial records to check for accuracy

- Managing and training finance office staff

Yes, you can become an Accountant with a Certified Financial Accounting: ICB National Diploma.

You can study Financial accounting online at Matric College. Online learning is a form of distance learning. With distance learning, you use the following online tools:

- Website

- Telephone

Of the 4 courses of the ICB Financial Accounting Programme, the recommended duration of studying each stream is different. Again, depending on your study pace you can take a shorter or longer time to complete. Here is the recommended duration for each course:

| STREAM / LEVEL | DURATION (RECOMMENDED) |

| 6 -12 months | |

| Bookkeeping: ICB FET National Certificate | 8 – 12 months |

| Technical Financial Accounting: ICB National Diploma | 8 – 12 months |

| Certified Financial Accounting: ICB National Diploma | 8 – 12 months |

The easiest and lowest of an Accounting job is Bookkeeping. Here you just deal with one type of transaction such as Accounts Receivable or Accounts Payable. One dealing with such can be called an Accounts Receivable Clerk or Accounts Payable Clerk.

Why Choose To Study With Matric College?

Here is what Matric College will do for you:

- We will make textbooks available for you

- We will provide you with study notes

- Our academic staff will attend to you from 08:00 am till 05:00 pm, Monday to Friday

- We can help you plan your timetable

- We will assist you with exam preparations

Here are your options on completion of your Certified Financial Accounting: ICB National Diploma:

- Look for employment opportunities

- Study further with the ICB

- Study further elsewhere

- Join a professional body

Look For Employment Opportunities

On completion of your Diploma you can look for employment opportunities. Remember, Financial Accounting is a scarce skill. This means that employers are always searching for Financial Accountants.

Study Further With The ICB

With ICB courses, you can qualify for another programme just by studying a few more subjects. For example, with your Certified Financial Accounting National Diploma, you will only need to study 8 of the 12 subjects on the ICB Office Administration Programme to qualify for the Office Administration: ICB National Diploma.

Study Further Elsewhere

You can study further with the following bodies, United Kingdom-based bodies, who will offer you exemptions because you hold a Qualification with ICB:

- Chartered Institute of Management Accountants (CIMA)

- Association of Chartered Certified Accountants (ACCA)

Join A Professional Body

When you join professional bodies you show that you take your career seriously. Here are some of the professional bodies that you can join:

- SAIT – South African Institute of Tax Practitioners

- SAIBA – South African Institute Of Business Accountants

- ACCA – Association of Chartered Certified Accountants – UK

- CIMA – Chartered Institute of Management Accountants – UK

- IAB – International Association of Bookkeepers – UK

- IAAP – International Association of Accounting Professionals – UK

According to payscale.com, here is what Financial Accountants earn:

| PROFESSIONAL LEVEL | AVERAGE SALARY / MONTH |

| Entry-level (0 – 3 years of experience) | R 23 000.00 |

| Middle level (4 – 9 years of experience) | R 29 000.00 |

| Senior level (more than 10 years) | R 33 000.00 |

Yes, Financial Accounting involves basic Math such as addition, subtraction, multiplication, and division.

Accounting focuses on recording and reporting financial transactions. This will include bookkeeping, financial statements, and financial transactions. Financial Accounting focuses on the planning and directing of financial activities for an organisation.

ICB is an institute that offers Business and Accounting courses to students. CIMA is an institute that offers further education and memberships to Financial Accounting students, including ICB students who get exemptions for up to 6 subjects.

Application Process

At Matric College we have a seamless application process you can follow online or over the phone. Here is how you can get your studies started:

- Complete the Download the Brochure Form at the bottom of this page

- Our course experts will contact you and complete your registration for an ICB Course

- Upon successful completion of your registration with Matric College, we will send your coursework and study materials via a courier.

How Do I Study Certified Financial Accounting: ICB National Diploma?

After registering with Matric College, here are the steps that you will need to take:

- Register as an ICB Student

- Register your student account on ICB MACCI

- Complete and submit your Assignments on ICB’s MACCI portal

- Write Open-Book Tests using the ICB MACCI portal

- Complete the exam entry form on MACCI

- Write your ICB final exam online or in-person

- Pass your exams

- An ICB Certificate will be awarded to you by Matric College once it is received from ICB and FASSET

When Can I Start Studying Certified Financial Accounting: ICB National Diploma?

You can apply today for the Certified Financial Accounting: ICB National Diploma Course and as soon as you receive your coursework and study materials (within 5 – 7 business days of registration) you can start studying.

Where Can I Study Certified Financial Accounting: ICB National Diploma?

You can study Certified Financial Accounting: ICB National Diploma at Matric College.

Frequently Asked Questions

The Institute of Certified Bookkeepers (ICB) is an Independent External Examination body. It has been in existence since 1931. It does not offer tuition or study material. Accredited Learning Providers like Matric College, offer tuition to students.

Yes, at ICB you can apply for Recognition of Prior Learning (RPL) for any work experience or studies completed within 5 years of starting an ICB Programme.

Work experience credits are awarded from a competency exam and previous studies credits are awarded if it is recognised on the National Qualifications Framework (NQF) and the qualification has a South African Qualifications Authority (SAQA) ID.

You will need to make an application to the ICB for the exemption.

It Is Important To Note That Credit Exemptions Are Not Guaranteed.

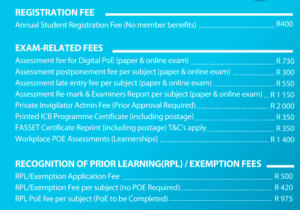

Yes, the ICB has associated fees for all the programmes and courses they offer which are payable to the ICB. Associated fees include:

- Registration Fees

- Exam-Related Fees

And Recognition of Prior Learning Fees

Above are the most updated prices of fees due to the ICB. Fees are correct as of the date of publication and are subject to change.

You will be issued with your Certificate about 3 – 6 months after the exam. This is after the auditing of the results and the printing of the Certificates.

No, a National Diploma and a Degree are not equivalent. According to the National Qualification Framework (NQF), a National Diploma is on level 6 while a Degree is on level 7.

Other Financial Accounting Courses

Author:Collin Wilbesi

Editor: Amy Venter

Date Published: February 23, 2022

Download a brochure

"*" indicates required fields

Financial accounting is a very specific branch of accounting that is an integral part of making any company run. The duties of financial accountants are as follows:

- Recording and summarizing transactions

- Accurately prepare financial reports

- Planning budgets

- Preventing fraud

- Compiling cash flow statements

It's a scarce skill

Financial accounting, with many other aspects of financial management, is a scarce skill in South Africa.

This means that a financial accounting qualification is in high demand and so you won’t struggle to find employment.

Why study an ICB accredited course?

The Institute of Certified Bookkeepers is an internationally reputable institution that offers courses in business and financial management. With an ICB accredited qualification, you can work anywhere in South Africa. Employers are well aware of the high quality nature of ICB qualification and are more likely to give you a job!

General information

- Programme type: Partner Programme

- Award type: National Certificate and a Programme Completion Certificate

- Awards issued by: FASSET will issue your National Qualification and the ICB will issue your Programme Completion Certificate.

- Accredited by: QCTO

- Course duration: 36 Months

Entry requirements

In order to apply for the ICB Financial Accounting Course, you must meet the following requirements:

- Be able to read and write in English: As the course and coursework will be in English, you will be required to read and write in English.

- Have successfully completed the ICB National Diploma in Technical Financial Accounting: To apply for the ICB financial accounting course, you must have completed the ICB national diploma. OR

- Be a qualified Certified Technical Financial Accountant: If you haven’t completed the diploma mentioned above, you must be a certified technical financial accountant to apply for this course.

Unable to meet the course requirements?

Want to study towards an ICB qualification but don’t meet the standard requirements? Apply for the Bridging Course!

The bridging course is perfect for students who want to further their studies towards an ICB qualification, but they don’t meet the standard entry requirements.

Our ICB Financial Accounting Courses:

- National Certificate in Junior Bookkeeping

- FET Certificate in Senior Bookkeeping

- National Diploma in Technical Financial Accounting

- National Diploma in Certified Financial Accounting

Subjects

You can expect the following subjects as part of the ICB Financial Accounting Course:

- Introduction to Business English

- Bookkeeping to Trial Balance

- Payroll and Monthly SARS Returns

- Computerized Bookkeeping

- Business Literacy

- Financial Statements

- Cost and Management Accounting

- Income Tax Returns

- Business Law and Accounting Control

- Corporate Strategy

- Management Accounting Control Systems

- Financial Reporting and Regulatory Frameworks

- Research Theory and Practise

Get in touch

Ready to launch your dream career? Get in touch with us and speak to one of our course experts on 012 762 7100.

Or fill out our call form!