ICB Technical Financial Accounting National Diploma is the third qualification in the ICB Financial Accounting Programme. This course equips you with skills and knowledge in Technical Financial Accounting such as:

- Completion of a set of accounts

- Assist management with finance and accounting skills

- Provide costing reports

- Prepare tax returns

- Manage cash and credit

- Create reduced costs strategies

Once you have completed this course you will be qualified to work in the Technical Financial Accounting field.

| Certificate Type | ICB National Diploma |

| Awarded By | FASSET |

| Award Type | FET Certificate and a Programme Completion Certificate |

| NQF Level | Level 5 |

| SAQA ID | 36213 |

| Credits | 251 |

| Entry Requirements |

|

ICB Technical Financial Accounting National Diploma Subjects

ICB Technical Financial Accounting National Diploma is made up of 2 subjects. You must first complete the 4 subjects from ICB Bookkeeping National Certificate and the 2 subjects from ICB Bookkeeping FET Certificate.

Completion of Subjects In ICB Bookkeeping FET Certificate

- Financial Statements (FNST)

- Cost and Management Accounting (CMGT)

Complete Subject List for ICB Technical Financial Accounting National Diploma

- Income Tax Returns (ITRT)

- Business Law and Accounting Control (BLAC)

Career Opportunities

- Technical Financial Accountant

- Financial Manager

- Financial Services Manager

- Accounting Technician

- Tax Technician

What Will I Learn?

- Process goods and services documents

- Maintain capital disposal records

- Estimate costs for projects

- Assist with the planning of an audit

- Classify and record data

- This subject will teach you to complete monthly SARS returns and give you knowledge on Tax processes.

- This subject will teach you how to run a business that complies with the law and regulations of commercial duties.

ICB Technical Financial Accounting National Diploma Assessments

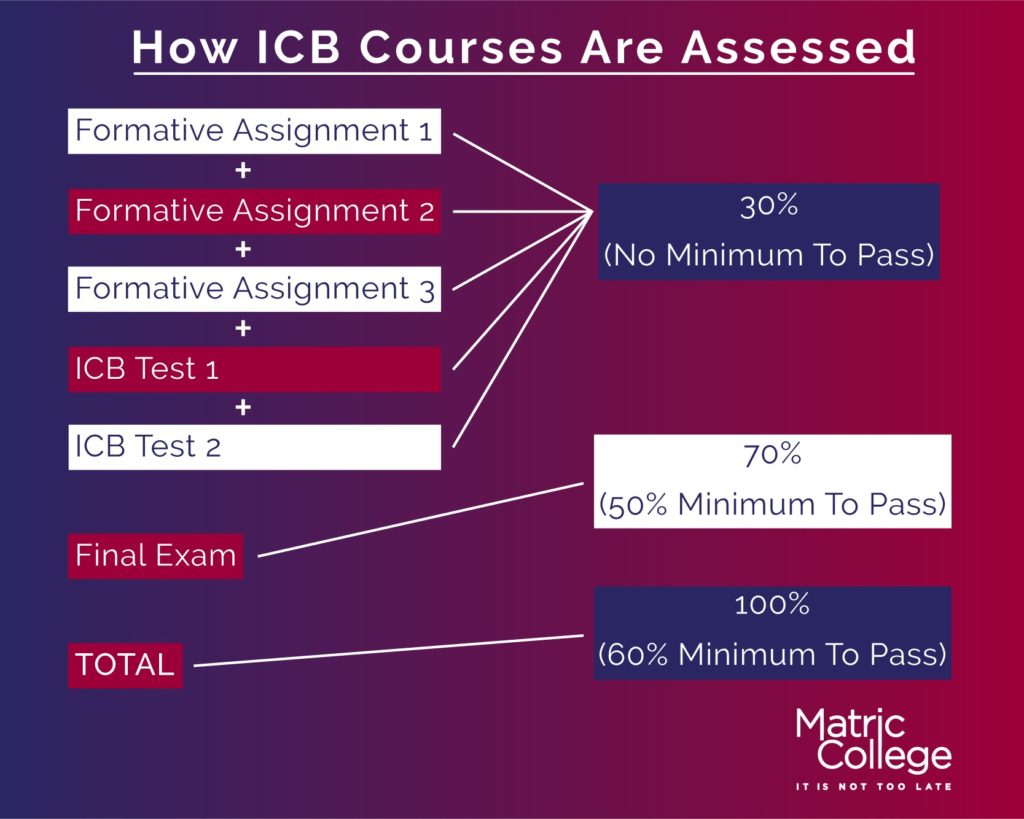

The ICB Technical Financial Accounting National Diploma assessments consist of assignments, tests, and examinations. You must complete these to pass the course. The assessments are set in a Portfolio of Evidence (PoE).

Portfolio of Evidence

The ICB Technical Financial Accounting National Diploma consists of a Portfolio of Evidence (PoE). The PoE consists of 3 assignments and 2 online tests. Each subject in the ICB Technical Financial Accounting National Diploma has a PoE which must be completed. You are also expected to write a final examination.

Exams

There are two types of exams in the ICB Technical Financial Accounting National Diploma. These are online and paper-based exams

Distance learning students write their exams at the ICB-approved examination centres as well as online. This applies from April 2021 onwards.

Online Exams

The online exams are written on the ICB MACCI Portal. Online exams are set for 01:00 pm to 04:30 pm.

Paper-Based Exams

The paper-based exams are written at a physical location booked by the ICB or at a provider college. The exams are set for 09:00 am to 12:30 pm.

The ICB Financial Accounting is a programme created by the Institute of Certified Bookkeepers (ICB). This programme consists of four (4) courses. These are the courses under ICB Financial Accounting Programme:

- ICB Bookkeeping National Certificate

- ICB Bookkeeping FET Certificate

- ICB Technical Financial Accounting National Diploma

- ICB Financial Accounting National Diploma

A Technical Financial Accountant is a professional who works with financial and accounting activities such as:

- Maintaining financial records

- Sending invoices

- Preparing tax returns

- Assisting with audits

To become a Technical Financial Accountant, you must study the ICB Technical Financial Accounting National Diploma. This course will prepare you for the Financial Technical Accounting field by equipping you with the necessary skills and knowledge. Once you have completed the course, you can look for employment in the Financial Accounting field.

R 421 728 yearly

The average salary for a Technical Financial Accountant is R 35 144 per month in South Africa.

Source: Indeed

Once you have completed the ICB Technical Financial Accounting National Diploma you can use the qualification to do the following:

- Find employment

- Study further

Find Employment

You can use the ICB Technical Financial Accounting National Diploma to look for employment. This qualification is desirable because:

It is a Diploma Qualification

- Diplomas are valued in the work environment because it is a step towards a Degree.

It offers scarce skills

- These skills are highly in demand in South Africa.

It is an accredited qualification

- Accredited qualifications are valued because they offer quality education according to the standards set by the NQF.

Study Further

You can further your studies by completing the next course, Certified Financial Accounting: ICB National Diploma, in the ICB Financial Accounting Programme.

After completing the ICB Technical Financial Accounting National Diploma, you can further your studies or look for employment. You can further your studies at a college or through the following professional bodies that recognise ICB courses:

- ACCA (Association of Chartered Certified Accountants UK)

- CIMA (Chartered Institute of Management Accountants UK)

- IAB (International Association of Bookkeepers UK)

- IAAP (International Association of Accounting Professionals UK)

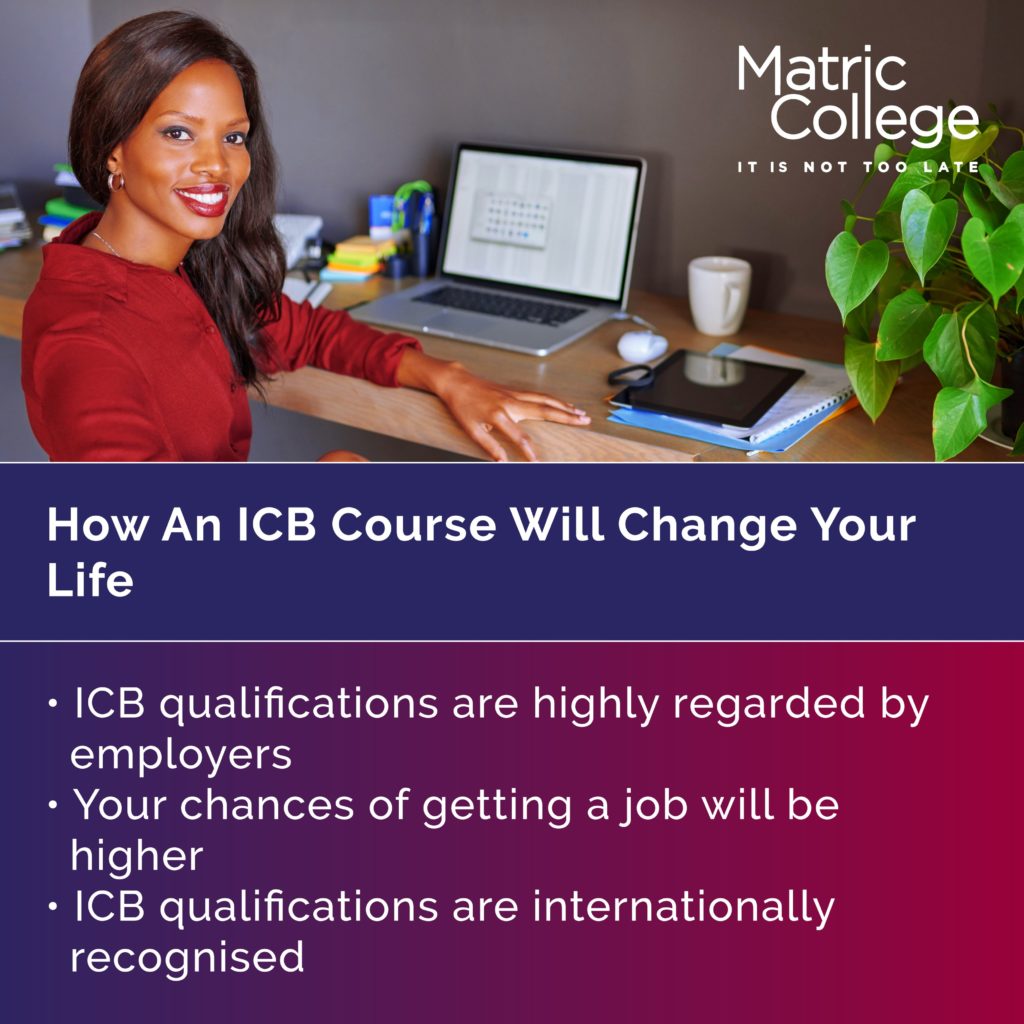

Yes, the ICB Technical Financial Accounting National Diploma is recognised. This qualification is recognised nationally and internationally. This means you can further your studies both in South Africa and abroad.

Yes, the ICB Technical Financial Accounting National Diploma is accredited by the Institute of Certified Bookkeepers (ICB) and the Quality Council of Trades and Occupations (QCTO).

Your Next Step Is To Get Your Certified Financial Accounting ICB National Diploma

Once you have completed the ICB Technical Financial Accounting National Diploma, you can study the Certified Financial Accounting ICB National Diploma. This is the last qualification in the ICB Financial Accounting Programme.

Why Choose To Study With Matric College?

- You can study from anywhere

- You create your own study sessions

- Study at the pace that suits you best

- You can work and be a student at once

- There are tutors available to assist you

- Facebook study groups are available to allow you to interact with other students

- You gain an accredited qualification ook for employment after your qualification

- You will be able to further your studies

Financial Accounting can be challenging if you are a student with the following qualities:

- You do not like Math

- You generally believe Financial Accounting is hard

Financial Accounting needs commitment like all other careers. It is easier to study if you love Financial Accounting activities and you are good at it.

Yes, Accountants do a lot of Math. Being an Accountant involves a lot of mathematical duties, such as preparing tax returns. You must have a passion for numbers to enjoy the work.

Students with the following qualities can find technical financial accounting easy:

- Students who love Financial or Accounting activities

- Students who are good with calculations

- Students interested in Technical Financial Accounting

- Students who want to work in the Financial Accounting field

- Students who are committed to studying

Yes, you should study Technical Financial Accounting if you are passionate about Finance and Accounting. It is easier to study a course that you have an interest in. If you want to work in an environment where you handle finances, you should study the ICB Technical Financial Accounting National Diploma course.

Students with the following qualities can study the ICB Technical Financial Accounting National Diploma course:

- Students who like working with numbers

- Students who are good at Mathematics

- Students who want to work in an office environment

- Students who are interested in Finance or Accounting

Yes, Technical Financial Accounting is a good career. This career allows you to advance yourself from one career to another. You can work as a Technical Financial Accountant. If you want to become an Accountant, you can apply for a Diploma Qualification in Accounting at university.

To become a licensed Accountant you will be required to write two board exams. These are sets of tests used to determine if you qualify to work as an Accountant.

These are the tests you must complete:

- Initial Test of Competency (ITC)

- Assessment of Professional Competence (APC)

Once you have completed this, you will be qualified as a registered Accountant in South Africa.

These are the differences between Accounting and Technical Accounting:

| Technical Accounting | Accounting |

| A qualification below Accounting | A qualification above Technical Accounting |

| Mid-working-level | Senior working-level |

| Provides a high salary | Provides higher salary |

| Does not require a license to work in the field | Requires a license to work in the field |

These are the duties of a Technical Accounting Manager:

- Monitor financial computer systems

- Develop strategies to improve financial reports

- Record clear financial reports to stakeholders

- Handle audits

- Filling tax returns

Application Process

The application process at Matric College is simple. You can complete this online or through the phone. Here is how you can apply:

- Click here to apply for the Technical Financial Accounting: ICB National Diploma

- Our course experts will contact you and register you for the Technical Financial Accounting: ICB National Diploma course

- When you have been successfully registered, we will send your study material by courier

- This process takes 5 to 7 days

How Do I Study ICB Technical Financial Accounting National Diploma?

Here is how you can study the Technical Financial Accounting: ICB National Diploma:

- Register as an ICB Student as outlined in your registration pack

- Sign up for ICB MACCI to build your Portfolio of Evidence (PoE)

- Complete and submit your Assignments on ICB MACCI

- Write your Open-Book Tests using the ICB MACCI Portal

- To register for the final exam, complete the ICB Student Portal exam entry form

- You can write the ICB final exam online or in-person (remember to submit your PoE)

- The ICB Bookkeeping National Certificate will be awarded to you by Matric College once it is received from ICB and FASSET

When Can I Start Studying ICB Technical Financial Accounting National Diploma?

Once you have been registered with one of our course experts for the ICB Technical Financial Accounting National Diploma, you will receive your course study material in 5 to 7 days. Once you receive this, you can start studying with us.

Where Can I study ICB Technical Financial Accounting National Diploma?

You can study the ICB Technical Financial Accounting National Diploma at Matric College. We are a distance learning college which means you study from home. You communicate with your tutors through email, calls, and WhatsApp. They are available to assist you Monday to Friday, 08:00 am to 05:00 pm.

Frequently Asked Questions

ICB is an independent External Examination Body that has been in the education industry since 1931. Their ICB courses are offered through training providers that are registered with them. Matric College is one of the training providers registered with the ICB. We offer all three (3) of the ICB programmes.

The ICB Student Portal is one of two online portals. You can do the following on the ICB student portal:

- Register for your ICB course

- Register for the ICB Exam (Matric College does NOT register students for exams)

- Get digital copies of qualifications and other official documents

- Pay associated course fees

- Update personal details

ICB MACCI is the second online portal. You can do the following on the ICB MACCI portal:

- Get updates on your course

- Complete your PoE

- Write and submit your assignments

- Complete online tests

- Write your examinations

Yes, you can apply for Recognition of Prior Learning (RPL) for the studies or work experience you completed within 5 years of enrolling for an ICB course.

Work Experience Credits

ICB will ask that you complete a Portfolio of Evidence that they send to you. The results will determine if they can give you credits or not.

Prior Learning Credits

You are given credits for prior learning if your previous qualification has the following:

- Registered on the NQF

- SAQA ID number

- NQF Level

- Proof of accredited provider e.g DHET

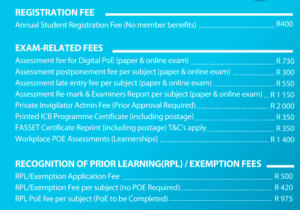

Yes, ICB courses have associated fees. All payments can be made through the ICB student portal. ICB fees include:

- Registration Fees

- Exam-Related Fees

- And Recognition of Prior Learning Fees

Above are the most updated prices of fees due to the ICB. Fees are correct as of the date of publication and are subject to change.

Once you have completed your ICB Qualification, your results will be audited. ICB will ask FASSET to prepare your Certificate. FASSET will send the Certificate to us and then we will award you with your qualification. This process takes 3 – 6 Months.

An ICB course is a course created by the Institute of Certified Bookkeepers (ICB). ICB courses are offered by training providers that are registered with ICB. Matric College is one of the training providers registered with ICB.

An ICB Diploma is a qualification you are awarded once you have completed an ICB Diploma course.

Other Financial Accounting Courses

Author: Mulisa Nethononda

Editor: Amy Venter

Date Published: February 23, 2022

Online Application Form

"*" indicates required fields