The Financial Accounting – Business Management: ICB National Diploma is the third and final course in the ICB Business Management Programme. You have to complete the second ICB Business Management course, which is the Office Administration – Business Management: ICB Higher Certificate, to gain entry into Financial Accounting – Business Management: ICB National Diploma.

All of our ICB courses build on to the next course. This is why you have to complete each course for each programme step by step. Here is a diagram that explains the process for the ICB Business Management Programme:

| Small Business Financial Management: ICB National Certificate | Office Administration - Business Management: ICB Higher Certificate | Financial Accounting - Business Management: ICB National Diploma | ||

|---|---|---|---|---|

After completing the Financial Accounting – Business Management: ICB National Diploma you can further your studies with any of our other ICB Programmes.

| Certificate Type | ICB National Diploma |

| Awarded By | FASSET |

| Award Type | National Certificate and a Programme Completion Certificate |

| NQF Level | Level 6 |

| SAQA ID | 20366 |

| Credits | 280 |

| Entry Requirements |

|

Financial Accounting - Business Management: ICB National Diploma Subjects

First Complete the Small Business Financial Management: ICB National Certificate:

- Business Management 1

- Bookkeeping To Trial Balance

- Business Literacy

Then Complete the subjects for Office Administration – Business Management: ICB Higher Certificate:

- Office and Legal Practice

- Business Management 2

- Marketing Management and Public Relations

- Financial Statements

- Human Resources Management and Labour Relations

Lastly, complete the subjects for Financial Accounting – Business Management: ICB National Diploma:

- Office and Legal Practice

- Business Management 2

- Marketing Management and Public Relations

- Financial Statements

- Human Resources Management and Labour Relations

After successfully completing and passing all of the above subjects you will be awarded the

Financial Accounting – Business Management: ICB National Diploma.

Career Opportunities

You can pursue the following career paths once you have completed Financial Accounting – Business Management: ICB National Diploma:

- Accounts Assistant

- Administrative Clerk

- Branch Administrator

- Buyers Assistant

- Compliance Support Agent

- Customer Service Manager

- Creditors Clerk

- Creditors Manager

- Database Administrator

- Data Capturer

- Field / Floor / Store / Department Supervisor

- Finance Administrator

- Labour Relations Manager

- Office and Procurement Administratrator

- Office Manager

- Operations Office Manager

- Payroll Clerk

- Personal Assistant to a Director

- Senior Office Administrator

- Secretary

- Team Leader: Student Support Office

What Will I Learn?

You will learn a variety of skills in this course, from Business Literacy to Human Resource Management skills. Here are some of the most important skills you will learn during this course:

- Preparing for a business audit (internal or external)

- Work with management information systems

- Use strategic thinking in a global business environment

- Draw up and interpret financial statements

Business Management 3: The purpose of this subject is to teach you how to run a business. This is the final and most comprehensive understanding of the subject.

Financial Management and Control: You will learn which procedures to take in order to control and direct the use of finances in a business.

Financial Reporting and Regulatory Frameworks: You will be introduced to different standards of accounting, whether they are national or international. As a result, you will be able to provide consistent financial reporting.

Research Theory and Practice (by short dissertation, topic: Business Management): The following is your research theory on Business Management. You will choose what to discuss about Business Management and why it is important to you.

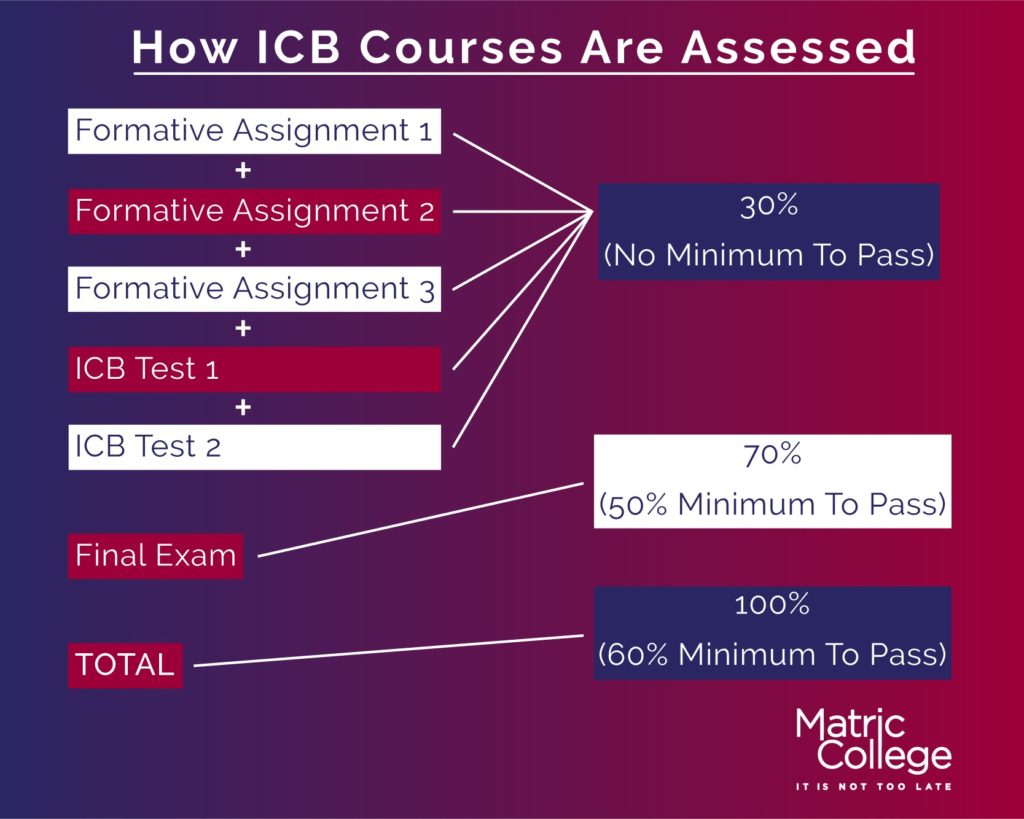

Financial Accounting - Business Management: ICB National Diploma Assessments

With the Institute of Certified Bookkeepers (ICB) comprehensive assessment process, you will be in the best position to succeed. Along with the final exam, you will complete a Portfolio of Evidence for each subject.

You can pass the exams easily as 70% of your final grade is based on the exams. The remaining 30% will be determined by your assignments and internal tests. Examine each component in detail.

Portfolio of Evidence

Your Portfolio of Evidence (PoE) determines whether you are prepared for the exams. The PoE consists of two internal tests and 3 Formative Assignments. In order to qualify for the exams, you must complete and pass the PoE.

Exams

The Institute of Certified Bookkeepers has two types of exams, namely:

- Online Exams

- Paper-based Exams

These options are available because ICB realises that each student wants to complete the exams differently. The COVID pandemic has allowed caused ICB to administer their exams online. After initially being wary about online exams, many students began to prefer them to paper-based exams. Discover how each exam works below.

Online Exams

Distance-learning students can take online exams, but this option is not only available to them. Students who take face-to-face exams can also take online exams, however, they need to check with their colleges before applying for the online exams.

Online exams are between (01:00 pm – 04:30 pm). If you are a distance learning student, you can apply and pay for the exam registration through the ICB Student Portal. If you are a face-to-face student, you can do so through your college.

Paper-Based Exams

A paper-based exam is taken at a physical location. Distance learners can also book these exams online.

Paper-based exams are between (09:00 am – 12:30 pm). If you are a distance learning student, you can apply and pay for the exam registration via the ICB Student Portal.

NOTE: The ICB distance venues (paper-based exams) can only accommodate a limited number of students due to COVID-19 protocols. Book your paper-based exam early to avoid disappointment.

Also NOTE: The ICB can cancel or withdraw any exams and / or venues at any time. Getting accepted into any exam booking by the ICB does not guarantee the exam sitting. Students who are affected by cancelled exams will be offered alternative exam dates.

Here is what you can do with a Diploma in Financial Accounting:

- Find employment

- Once you have your National Diploma in Financial Accounting, more employment opportunities are available. Most employers employ students that have completed their National Diploma.

- Further your studies at Matric College with another ICB Programme

- All of our ICB courses are internationally recognised, which means you can find employment opportunities abroad

- Further your studies at Matric College in a different field of study

We offer a range of courses at Matric College. These include Short Courses and Diploma Courses.

A Diploma in Financial Accounting is a course that can either be at NQF Level 5 OR NQF Level 6. This is determined by the credits of the course.

A Diploma in Financial Accounting equips students with the necessary skills and knowledge to start their career in an accounting environment. This course is also the stepping stone to becoming an Accountant.

Yes, a Diploma in Financial Accounting is useful. A Diploma in Financial Accounting allows you to work in any industry because the skills you learn in the course can be used in any other field. Throughout the course, you will develop analytical skills and learn how to deal with common scenarios you will face in the workplace.

No, you cannot become a Chartered Accountant with a Diploma in Accounting. You have to complete a Chartered Accountant Degree course. A Diploma in Accounting can help you achieve your goal of becoming a Chartered Accountant. You can apply to a university for a Diploma course and then a Chartered Accountant Degree course.

NOTE: Each university has its own entry requirements and separate entry requirements for its courses.

A Post Graduate Diploma in Accounting (PGDA) is a one-year Programme that prepares students for the Initial test of Competence (ITC) set by the South African Institute of Chartered Accountants.

No, a National Diploma is not equivalent to a Degree. A National Diploma is at NQF Level 6 and a Degree is at NQF Level 7.

The main difference between these two Diplomas is the purpose and exit-level outcomes. However, both Diplomas are on the same NQF Level, which is at an NQF Level 6. This does not mean that they are equivalent to one another.

Here are the main differences between these two Diploma’s:

| National N Diploma | National Diploma | |

| Course Duration | Between 6 months and 4 years | Between 1 and 3 years |

| Designed by | The Department of Higher Education and Training | The College or University |

| Components | Has both a practical and theoretical component | ONLY has a theoretical component |

| Awards achieved | Your awards are broken down into parts. N1, N2, N3, N4, N5, and N6 | You only get one award or qualification |

Here are some of the benefits of doing a National Diploma:

- Skills are more valuable than degrees to employers

- A Diploma can help you gain employment faster

- There is a possibility that you will earn more money

- Diplomas are more affordable

- You can complete a Diploma in a flexible learning environment

Yes, Financial Accounting is a good career. Here is why you should complete a Financial Accounting course:

- All businesses need people with financial experience and skills

- You can gain more insight into your own finances

- You can gain more insight into your business finances

- The skills you learn are transferable

- You can use the skills learned in finance in any other industry

- Financial Accounting is a scarce skill in South Africa

- Every business needs a person with Financial Accounting skills

Your Next Step Is To Find Employment OR Further Your Studies

The Financial Accounting – Business Management: ICB National Diploma is the final course in the ICB Business Management Programme. After completing this course you can:

- Find Employment: Here are some of the factors to consider when applying for work after you have received your Diploma in Financial Accounting

- Seek employment that matches your qualifications

- Find work that matches the amount of experience you have

- Work for an employer who shares the same values as you

- Further your studies: Here are some of the factors to consider when you further your studies

- Some universities still look at your Matric Pass Level, regardless of the qualifications you have completed after Matric

- You might gain entry to a university but not for the course you are interested in

Why Choose To Study With Matric College?

Matric College is the ideal option for students who enjoy distance learning.

Distance learning is a learning method that does not require you to attend physical classes. Busy students can benefit from distance learning. We have several benefits for you to consider:

- We offer unique payment options: Here are your options:

- Advance payments (full payment of your studies)

- Split payments (half of the total fee at the beginning of the year and the other half of the total fee at the end of the year)

- Monthly payments (pay an installment each month)

- Unique payment method (we will find a method that suits both of us)

- You can study and work: It is possible to work full-time and study full-time. Class attendance is not required. You only have to submit assignments, write the tests and final exams.

- Set up your own study schedule: You can decide how much time you want to devote to studying. Matric College understands the importance of family life, earning a living, and balancing studies.

- Get tutor assistance from us: We have tutors that are available to help you. Contact our tutors online or put in callback requests online.

Our friendly support team checks in on your progress: We will call you regularly to find out how you are doing and to remind you of important dates.

In any business, the following three types of Finance Management are considered important:

- Capital Budget Management

- Capital Structure Management

- Working Capital Management

Capital Budget Management

This is the planning procedure that is used in a company to decide if a company’s assets (new machinery, new research projects) are worth allocating funds to. The Finance department will determine where, when and how money should be allocated.

Capital Structure Management

Capital structure management tries to safeguard the ongoing business operations and ensures flexible access to capital markets.

Working Capital Management

This is when the company manages bookkeeping methods and accounting strategies to keep track of current assets and liabilities.

The decisions that Financial Managers make are:

- Dividend decisions

- Financing decisions

- Investment decisions

- Managerial decisions

Dividend Decisions

The reward given to shareholders in return for their investments, trust, and confidence is what is called the dividend. The Financial Manager decides to keep a part of the dividend in case the company needs it in the future.

Therefore, we could also say that the Financial Manager decides how to divide the portions of the profit amongst themselves.

Financing Decisions

Companies make financing decisions to ensure the financial stability of the company. Each company requires funding regularly, so it is a continuous and ongoing process. As a company grows, its needs increase.

Investment Decisions

These decisions relate to all of the financial decisions that include investments. This could be assets, instruments, or securities. This all depends on the type of company it is.

Managerial Decisions

All of the decisions are related to managing the employees who work under the Financial Manager but it is not only limited to the financial department.

For example, you can inform all of the employees about reduced salaries or increased salaries, etc.

No, a Diploma in Accounting does not make you an Accountant. It does, however, make you a qualified Bookkeeper or Assistant Accountant. You could also get other positions in the finance industry. You can move in the direction of an Accountant if you decide to further your studies. A Diploma in Accounting can be the stepping stone to becoming an Accountant.

Do some research before applying to universities because each university has different entry requirements and each course has different entry requirements.

Your options with a Diploma in Accounting are endless. For example, you can become a Loan Officer with a Diploma in Accounting OR a Bank Teller at a leading financial institution.

The main thing you need to know about the Financial Accounting – Business Management: ICB National Diploma course is that it can be a stepping stone for you to become an Accountant and then a Chartered Accountant.

How does this work?

Here are all the steps you can take to become an Accountant:

Step 1: Start your journey with us and complete the ICB Business Management Programme:

- Small Business Financial Management: ICB National Certificate

- Office Administration – Business Management: ICB Higher Certificate

- Financial Accounting – Business Management: ICB National Diploma

Step 2: Complete a Bachelor’s of Accounting at a university

- Your first step should be to apply for a diploma course at a university then apply for a degree course

- Please note that each university has its own entry requirements and separate entry requirements for its courses

- A university might still look at your Matric Pass Level regardless of the qualifications you have achieved before. (Complete a Matric Upgrade Programme with us if you want to improve your Matric marks)

After these two steps you can become an accountant

Step 3: Complete a Chartered Accountant Qualification

- This is the next step you can take after completing our Financial Accounting Programme and a Bachelor’s of Accounting

NOTE: Each company has its own hiring criteria and therefore they will make the final decision to employ you with OR without your qualification. The same applies to your work experience.

Both industries pay well. The salary you receive is influenced by the following factors:

- Educational background

- Level of experience

- Position you apply for

NOTE: Each company has its own hiring criteria. This means that regardless of the above factors the employer still has the last say in who he / she wants to employ. They can also decide HOW MUCH they would like to pay you.

For example: A company decides to pay their Loan Consultant R 20 000 per month whereas another company decides to pay an Assistant Accountant R 15 000 per month.

The company may not be concerned with the factors mentioned above BUT purely based on what the company can afford to pay their employees.

All finance jobs are considered in demand in South Africa because they are scarce skills. Here is a list of the different types of finance positions that are in demand in South Africa, along with the salary you will receive.

| Position | Work Experience |

| Financial Manager |

|

| Financial Analyst |

|

| Sales Manager |

|

| Operations Manager |

|

This depends on what your interests, skills, and abilities are as an individual. If you prefer Accounting OR Finance more. Here is what each sector includes:

| Accounting | Finance |

| The focus is on applying strict rules to Mathematics. | The focus is more on understanding Economics and some Accounting factors. |

| Concentrate on a company’s transactions | Identify ways to collaborate with other businesses |

Application Process

Here is how you can apply for the Financial Accounting – Business Management: ICB National Diploma Course:

Step 1: Contact us

You can contact us through the following ways:

- You need to fill out an online application form

- Book a call

- We can be reached by phone (021 838 8295)

- Visit us at our physical address

Step 2: Speak to one of our friendly course experts

Find a course that suits your interests with the help of our course experts.

Step 3: Register for one of our courses

Due to the nature of our college, you can apply at any time of the year.

Step 4: Write the exams

After you have completed your first programme, you can continue your studies. You can apply for another ICB Programme after you have passed the exams. The other ICB Programmes include:

How Do I Study Financial Accounting - Business Management: ICB National Diploma?

| Step 1: Use the instructions in your registration pack and register as an ICB Student |

| Step 2: To get your Portfolio of Evidence (PoE) you have to register on the ICB MACCI Portal |

| Step 3: Submit all of your assignments on ICB MACCI |

| Step 4: Write the open book tests on the ICB MACCI Portal |

| Step 5: Once you are ready, you can register for the final exam on ICB MACCI |

| Step 6: Take the online or paper-based exams |

| Step 7: Upon successful completion, you will receive your Certificate from Matric College |

When Can I Start Studying Financial Accounting - Business Management: ICB National Diploma?

A student can begin studying at any time of year. Matric College offers distance learning courses. Therefore, you can apply whenever you are ready. The exams work the same way.

You may register for the exams on the ICB Student Portal once you feel prepared to write them. You are in full control of your education and career path.

When Can I Start Studying Financial Accounting - Business Management: ICB National Diploma?

ICB offers their courses, through distance learning institutions amongst many. Matric College is one of the many distance learning institutions that offers ICB courses.

Frequently Asked Questions

The Institute of Certified Bookkeepers (ICB) conducts independent external examinations. This Institute offers three ICB Programmes through accredited institutions. Although ICB itself does not provide these courses, there are training providers that do.

Matric College offers the course and study material for the course amongst other training providers. ICB is responsible for administering exams, online tests and final examinations, assignments, and the Portfolio of Evidence.

ICB Student Portal is one of two online portals students can use (the other is ICB MACCI) to:

- Apply to be an ICB student

- Take the ICB Exam (Matric College does not register students for exams)

- You can retrieve digital copies of your documents and qualification certificates on the portal

- Pay ICB the associated fees

- You may update your personal information if it has changed or if it is wrong

Yes, ICB will accept Recognition of Prior Learning (RPL) based on work experience and studies completed within five years of starting an ICB programme.

Work experience and previous studies can earn you credits if they are recognised by the National Qualification Framework (NQF). It MUST have a South African Qualifications Authority (SAQA) ID.

It Is Important To Note That Credit Exemptions Are Not Guaranteed.

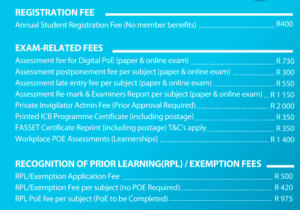

Yes, there are associated fees for all the ICB Programmes and courses. they offer which can be paid directly to ICB. Associated fees include:

- Registration Fees

- Exam-Related Fees

- And Recognition of Prior Learning Fees

Above are the most updated prices of fees due to the ICB. Fees are correct as of the date of publication and are subject to change.

Once your results have been reviewed and your Qualification is approved for Graduation, ICB will direct FASSET to print your certificate. FASSET will then prepare your Certificate which gets sent to Matric College. We will then send your Certificate to you via courier.

This process can take between 3 – 6 Months.

Yes, ICB Qualifications are recognised:

- Nationally Recognised

- Internationally Recognised

Nationally Accredited

- National Qualifications Framework (NQF)

- South African Qualifications Authority (SAQA)

- Quality Council for Trades and Occupations (QCTO)

- Institute of Certified Bookkeepers (ICB)

- All training providers are accredited by the Department of Higher Education and Training (DHET)

Internationally Accredited

The courses provided by the ICB are internationally recognised by professional bodies or membership for further studies. Here are all the professional bodies:

- ACCA (Association of Chartered Certified Accountants – UK)

- CIMA (Chartered Institute of Management Accountants – UK)

- IAB (International Association of Bookkeepers – UK)

IAAP (International Association of Accounting Professionals – UK)

An ICB Qualification is designed by the ICB to create pathways for students to obtain affordable credible business courses. Here are the three Programmes offered by Matric College:

- Financial Accounting (apply with a Grade 10 Certificate)

- Business Management (apply with a Grade 11 Certificate OR the ICB Bridging course)

Office Administration (apply with a Matric OR Matric Equivalent Certificate OR the ICB Bridging course)

R 35 196 per month

The average salary for a Financial Accountant is R 35 196 per month in South Africa.

Source: Talent.com

Other ICB Business Management Courses

Author: Jesmé Africa

Editor: Amy Venter

Date Published: February 21, 2022

Online Application Form

"*" indicates required fields