Course Summary

Award type:

Accredited by:

Duration:

Entrance Requirement:

The Small Business Financial Management: ICB National Certificate Course is the first course in the ICB Business Management Programme. In this course, you will learn the basics of business strategy, human resource management, financial and business management, computer literacy, and research methods.

After completing the Small Business Financial Management: ICB National Certificate course, you will receive an ICB National Certificate (NQF 4). This certificate is also equivalent to a Matric Certificate.

A Matric Equivalent Certificate is on the same NQF Level as a Matric Certificate which is at an NQF Level 4.

| Certificate Type | National Certificate |

| Awarded By | FASSET |

| Award Type | National Certificate and a Programme Completion Certificate |

| NQF Level | Level 4 |

| SAQA ID | 48736 |

| Credits | 120 |

| Entry Requirements |

|

Small Business Financial Management: ICB National Certificate Subjects

Here are all the subjects you need to complete for the Small Business Financial Management: ICB National Certificate:

- Business Management 1

- Bookkeeping To Trial Balance

- Business Literacy

Career Opportunities

The Small Business Financial Management: ICB National Certificate course is a scarce skill qualification. After you complete a Small Business Financial Management Course, you can pursue the following career paths:

- Administration

- Assistant in Human Resource

- Customer Relations

- Junior Analyst

- Sales Assistant

What Will I Learn?

- How to communicate efficiently and effectively with business partners and stakeholders. This means that you will learn how to use business language and how to deal with resolving conflict and finding solutions that meet all the parties affected.

- The skills you will learn will help you manage capital and cost products effectively

- This course will teach you how to understand, control, record, and manage the financial transactions of a business

Small Business Financial Management: ICB National Certificate Assessments

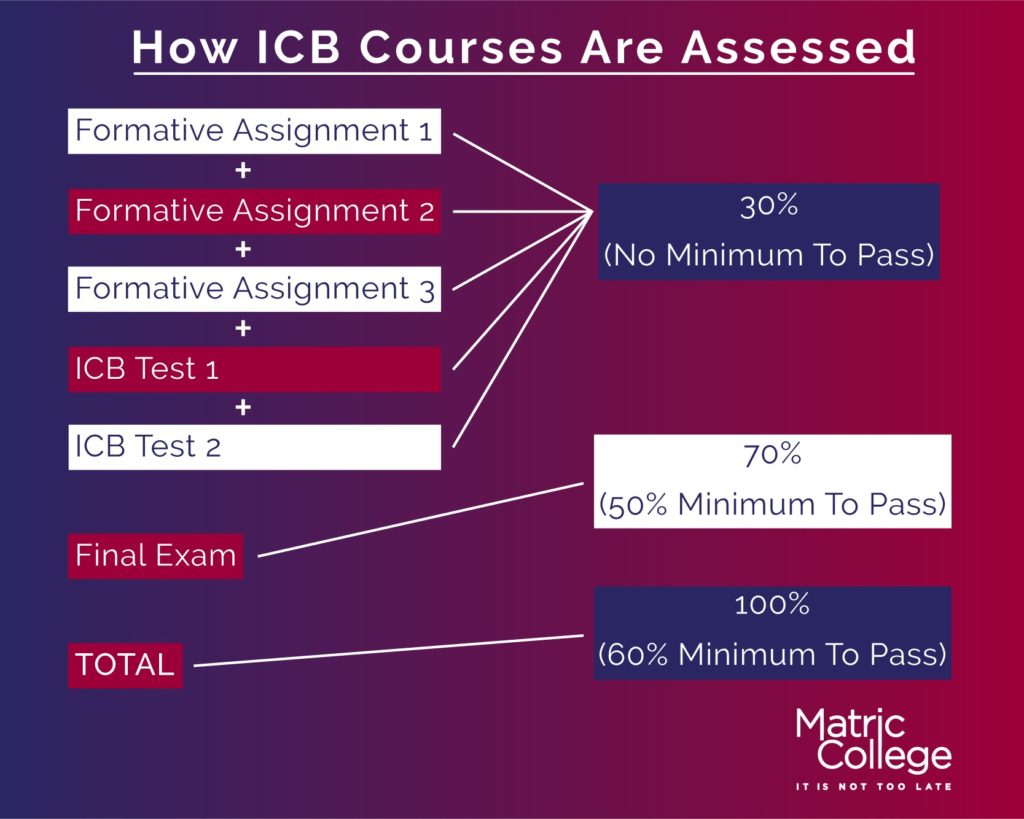

The Institute of Certified Bookkeepers (ICB) unique assessment criteria is designed to give you the best chance of succeeding. Each subject you complete will consist of a Portfolio of Evidence and the final exams.

The exams count 70% towards your final mark, which gives you the opportunity to pass with flying colours. The other 30% will count towards your assignments and internal tests. Learn more about each component.

Portfolio of Evidence

Your Portfolio of Evidence (PoE) is what determines whether or not you are prepared for the exams. The PoE consists of 3 Formative Assignments and two tests. You have to complete the PoE to gain entry to the exams.

Exams

ICB has two types of exams, namely:

- Online Exams

- Paper-based Exams

ICB offers these options to students because they realise that each student has different preferences, and because of COVID protocols they have decided to go online with their exams.

Although many students were at first hesitant about the online exams, students started preferring online exams to paper-based exams.

Online Exams

Online exams are a perfect option for students who prefer to study from home BUT this option is not limited to distance learning students only. Face-to-face students can also choose this option BUT have to make sure with their College before applying for the online exams.

Online exams are between 01:00 pm – 04:30 pm. If you are a distance learning student, you can apply and pay for the exam registration on the ICB Student Portal. Face-to-face students can apply via their College.

Paper-Based Exams

Paper-based exams are the “regular exams” that are completed at a specified venue. Distance learning students can also book for these exams online.

Paper-based exams are between 09:00 am – 12:30 pm. If you are a distance learning student, you can apply and pay for the exam registration on the ICB Student Portal.

NOTE: The ICB venues (paper-based exams) can only accommodate a limited number of students due to COVID-19 protocols. Book your paper-based exam early to avoid disappointment. Also NOTE: The ICB can cancel or withdraw any exams and / or venues at any time. Getting accepted into any exam booking by the ICB does not guarantee the exam sitting. Students who are affected by cancelled exams will be offered alternative exam dates. |

ICB Business Management is one of the Programmes that are offered by ICB. This programme has three courses namely:

- Small Business Financial Management: ICB National Certificate

- Office Administration – Business Management: ICB Higher Certificate

- Financial Accounting – Business Management: ICB National Diploma

The main focus of this programme is to give students the skills and knowledge to:

- Manage a business

- Manage a team within a business

- Become an entrepreneur (Start your own business)

Small Business Entrepreneurs are business owners that own and operate a business with a small number of employees and a low volume of sales. Small businesses can be identified by:

- Assets

- Sales

- Profit

Small Business Entrepreneurs aim solely to earn profits. They, usually, are NOT looking for growth and are generally not keen on expanding their business. The most common Small businesses are defined as partnerships and proprietorships.

Yes, Small Business Management is a good career. Here are some of the reasons why it is a good career:

- It is a scarce skill qualification

- You get paid well

- The skills you learn are transferable

It Is A Scarce Skill

Scarce skill qualifications are qualifications that are in demand. This means that these are the skills that are in demand in South Africa, which in turn makes you highly employable and you stand a chance of earning a decent salary.

You Get Paid Well

Small Business Financial Management is a scarce skill qualification, and people who have these skills or qualifications generally earn a decent salary. Due to the need for employees with these skills, employers are willing to pay well for their services.

The Skills You Learn Are Transferable

You can use the skills you have learned in the Small Business Financial Management: ICB National Certificate course and apply them in other fields that are NOT related to this particular field of study. Most of the skills acquired are also necessary for other working environments.

For example, you can use the skills acquired in the Small Business Financial Management: ICB National Certificate course and use it in a Receptionist position.

Here are the 5 types of business structures in South Africa:

- Sole proprietorship

- Partnerships

- Franchise

- Propriety Limited Company

- Public Company

No, it is not hard to study Small Business Financial Management. To become a successful student you need to look at the following factors:

- Always make time for your studies

- Find the study method that works for you

- Have a study timetable and make another person aware to keep you accountable

- Ask for help when you need it

Small businesses manage their finances the same way bigger businesses manage their finances. However, it is on a smaller scale. Small businesses focus on the following:

- Planning the financial future of your business

- Managing cash flow

- Making your payroll process more efficient

- Increasing inventory accuracy

- Take steps to manage supply chain risks

Financial Management is important for Small Businesses for the following reasons:

- Its a reminder of what the Small Business goals are

- It helps small businesses see and understand their profits

- Small businesses can set prices and plan inventory with Financial Management

- Financial Management can affect how a small business makes money

- The type of financial decisions can affect a business

Your Next Step Is To Get Your Office Administration - Business Management: ICB Higher Certificate

This is the second course in the ICB Business Management Programme. In this course, you will learn more about the Business Management Programme. This course includes the following subjects:

- Office and Legal Practice

- Business Management 2

- Marketing Management and Public Relations

- Financial Statements

- Human Resources Management and Labour Relations

Why Choose To Study With Matric College?

Matric College is the perfect option for students who are comfortable with distance learning. Distance learning is a type of learning that does not require you to attend physical classes. This type of learning is perfect for busy students. Here is why you should choose to study with us:

- We offer unique payment options: We offer different payment options. Here are your options:

- Advance payments (Pay your studies in full)

- Split payments (Half at the beginning of the year and the other half, the end of the year)

- Monthly payments (pay a fixed monthly installment)

- Unique payment method (We will help you find a payment method that works for both of us)

- You can study and work: You can work full-time and study full-time. You do not have to attend any classes. You only have to submit assignments, write the tests and final exams.

- Set up your own study schedule: You can decide how much time you can put into your studies. At Matric College, we understand the importance of family life, earning a living, and balancing your studies.

- Get tutor assistance from us: We have tutors that are available to help you where you are struggling. Contact our tutors online or put in a request for a callback.

- Our friendly support team checks in on your progress: This means that you will get regular calls to find out OR remind you of your assignments and exam dates.

No, the Small Business Financial Management course does NOT have a lot of Math. However, you must know the basics of Maths to consider a course in Small Business Financial Management.

Yes, you can study Small Business Management without Maths. However, you need to know the basics of Maths in order to complete the course. The table below will determine whether OR not you are prepared for a Small Business Financial Management course:

| QUESTIONS | YES/NO |

|---|---|

| Do I enjoy working with numbers? | YES |

| Am I good with numbers? | YES |

| Do I plan budgets well? | YES |

| Can I analyse financial data well? | YES |

| Do I know how to save money? | YES |

If you have answered “YES” to at least 3 of the 5 questions then you should consider studying the Small Business Financial Management: ICB National Certificate.

No, you do not need Pure Maths to study Small Business Financial Management. You only need to understand the basics of Maths to study Small Business Financial Management. This means that you can apply for the course with Mathematical Literacy OR without Mathematics.

Remember that the course does consist of basic Mathematics therefore you should have some foundation OR understanding of Mathematics.

The types of budgets that are applicable to small businesses are:

- Operating budgets

- Cash flow budget

- Financial budget

- Sales budget

- Product budget

- Labour budget

- Capital budget

Financial Management in a business is exactly what it says. It is managing the finances of your business. This can range from how you use the money in your business to where it is spent.

- Financial Management is the main way to ensure the success of your business

- Financial Management lets you know if your business is successful

- Financial Management can help you decide what you can afford

- Financial Management helps you decide how much you can spend and how you should set your prices

- Financial Management can help you determine what to do for the future

Here is how you can start up your own successful small business:

- Write down your business plan (any business plan)

- Determine how you will make a profit

- Start with as much of your own money as possible to avoid debt

- Start your small business small then expand

- Register your business

- Hire people that share the same values as you

- Pay your bills and taxes on time

Application Process

Here is how you can apply for the Small Business Financial Management Course:

Step 1: Contact us

You can contact us through the following ways:

- Complete an online application form

- Book a call

- Contact us on our landline (021 838 8295)

- Visit us at our physical address

Step 2: Speak to one of our friendly course experts

Our course experts will assist you with the course that best suits your interest.

Step 3: Register for one of our courses

You can apply any time of year because we are a distance learning college.

Step 4: Start your studies

Complete your first course at Matric College. Once you have written the exams and passed successfully you can apply for the next course in the ICB Business Management Programme, which is the Office Administration – Business Management: ICB Higher Certificate.

How Do I Study Small Business Financial Management: ICB National Certificate?

| Step 1: Register as an ICB student using the instructions in your registration pack |

| Step 2: Create an account on ICB MACCI to get your Portfolio of Evidence (PoE) |

| Step 3: Submit your assignments on ICB MACCI |

| Step 4: Write the open book tests on ICB MACCI |

| Step 5: Register for the final exam on ICB MACCI |

| Step 6: Write the online OR paper-based exams |

| Step 7: On successful completion receive your Certificate from Matric College |

When Can I Start Studying Small Business Financial Management: ICB National Certificate?

You can start studying any time of the year. Matric College is a distance learning institution. As a result, you can apply whenever you are ready. The exams work the same way.

Once you feel prepared to write the exams you can go on the ICB Student Portal and register for the exams. This puts you in complete control of your studies and future career path.

Where Can I Study A Small Business Financial Management: ICB National Certificate?

You can study an ICB course at many distance learning institutions such as Matric College.

Frequently Asked Questions

The Institute of Certified Bookkeepers (ICB) is an Independent External Examination body. They offer three ICB Programmes through accredited institutions. ICB does not offer these courses directly, but there are training providers who do.

Matric College is one of the training providers that provide the course and study material. ICB administers the examination, online tests, assignments and the Portfolio of Evidence.

- Register as an ICB student

- Take the ICB Exam (Matric College does not register students for exams)

- Documents and qualification certificates can be retrieved as digital copies

- Pay the fees associated with ICB

- Keeping your personal information up to date

Students have access to ICB MACCI as another online portal through which they can:

- Watch the progress of their course

- Completing and submitting your assignments

- Create online tests and exams

- Completion of the digital portfolio

Yes, ICB will accept Recognition of Prior Learning (RPL) for work experience and education obtained within five years of starting an ICB Programme.

You can earn credits for work experience and previous studies if they are recognised by the National Qualification Framework (NQF). Your qualification MUST have a South African Qualifications Authority (SAQA) ID.

| It Is Important To Note That Credit Exemptions Are Not Guaranteed. |

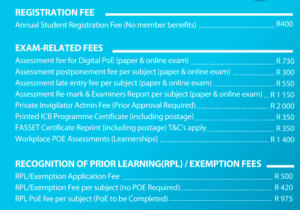

Yes, ICB has associated fees for all the programmes and courses they offer which can be paid directly to the ICB. Associated fees include:

- Registration Fees

- Exam-Related Fees

- And Recognition of Prior Learning Fees

| Above are the most updated prices of fees due to the ICB. Fees are correct as of the date of publication and are subject to change. |

Your results will be reviewed by ICB, and if your Qualification is approved for Graduation, ICB will direct FASSET to print your certificate. FASSET will then prepare your Certificate and send it to Matric College. We will then send your Certificate to you via courier.

This process can take between 3 – 6 Months.

After you have completed the Small Business Financial Management: ICB National Certificate, you can do the following:

- Find Employment

- Further your studies with the same ICB Business Programme

- Further your studies with another ICB Programme

- Further your studies and complete a NATED Qualification

Find Employment

You can find employment after you have completed the Small Business Financial Management: ICB National Certificate. Here are some of the factors you need to consider:

- The position you are applying for

- Your educational background

- Your level of experience

NOTE: Each company has its own hiring criteria. This means that regardless of the above-mentioned factors, the company ultimately decides how much they are willing to pay and which position they have available for you. E.g A student with a Financial Accounting: ICB Diploma, with 2 years experience in the finance field might get paid R 10 000 per month for an Assistant Accounting position. OR A student with a Small Business Financial Management: ICB National Certificate, with 1-year experience, might get paid R 20 000 for a Sales Agent position. |

Further Your Studies With The Same ICB Business Programme

After you have completed your Small Business Financial Management: ICB National Certificate, you can further your studies in the same Programme.

This means that you can continue with the Office Administration – Business Management: ICB Higher Certificate, and then complete the last course in the programme, which is the Financial Accounting – Business Management: ICB National Diploma.

Further Your Studies With Another ICB Programme

You can further your studies with another ICB Programme. We do not only offer the ICB Business Management Programme. We also have an ICB Financial Accounting Programme and an ICB Office Administration Programme.

The beauty about all of our ICB Programmes is that they all relate to each other. As a result, some of the subjects are similar, you will not have to complete them again if you have already completed them and passed.

R 14 004 per month

The average salary for an Entrepreneur is R 14 004 per month in South Africa.

Source: Indeed

| Position | Salary Per Month |

|---|---|

| Actuary | R 650 000 per month |

| Business Analyst | R 73 756 per month |

| Business Consultant | R 24 000 per month |

| Group Manager | R 85 000 per month |

| Project Manager | R 60 000 per month |

Author: Jesmé Africa

Editor: Amy Venter

Date Published: February 18, 2022

Online Application Form

"*" indicates required fields