![Grade 12 [Matric: Accounting] past papers and memos](https://www.matric.co.za/wp-content/uploads/2022/09/Screen-Shot-2022-09-13-at-11.06.45-AM.png)

Accounting Paper 1 2020

INSTRUCTIONS AND INFORMATION

Read the following instructions carefully and follow them precisely.

- Answer ALL the questions.

- A special ANSWER BOOK is provided in which to answer ALL the questions.

- Show ALL workings to achieve part-marks.

- You may use a non-programmable calculator.

- You may use a dark pencil or blue/black ink to answer the questions.

- Where applicable, show ALL calculations to ONE decimal point.

- Write neatly and legibly.

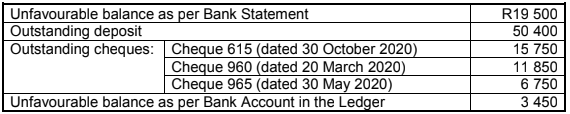

Use the information in the table below as a guide when answering the question paper. Try NOT to deviate from it.

QUESTION 1: MANUFACTURING (45 marks; 25 minutes)

1.1. Choose an example in COLUMN B that matches the cost category in COLUMN A. Write only the letter (A–E) next to the question numbers (1.1.1 to 1.1.5) in the ANSWER BOOK.

| COLUMN A | COLUMN B |

1.1.1. Selling and distribution 1.1.2. Direct labour 1.1.3. Administration 1.1.4. Factory overhead cost 1.1.5. Direct material | A) raw material issued for production B) bad debts C) depreciation on factory machinery D) production wages E) bank charges |

(5 x 1) (5)

1.2. BERGVIEW MANUFACTURERS

This information relates to the financial year ended 29 February 2020. The business manufactures buckets.

REQUIRED:

Prepare the following on 29 February 2020:

1.2.1. Factory Overhead Cost Note (16)

1.2.2. Production Cost Statement (10)

INFORMATION:

A. Stock balances

| 29 February 2020 R | 28 February 2019 R | |

| Work-in-progress | ? | 130 000 |

| Finished goods | 140 000 | 155 500 |

| Indirect material | 14 300 | 12 400 |

B. Amounts extracted from the records on 29 February 2020

| R | |

| Salary: factory foreman | 150 000 |

| Depreciation on factory equipment | 145 000 |

| Direct material cost | 2 200 000 |

| Direct labour cost | 1 209 300 |

| Indirect material purchased | 33 100 |

| Insurance | 60 000 |

| Water and electricity | 115 000 |

| Rent expense | 113 000 |

| Sales | 6 500 000 |

| Cost of sales (mark-up on cost: 60%) | ? |

- Insurance is shared by the factory, administration and the selling department in the ratio 3 : 2 : 1.

- Water and electricity for February 2020 is still outstanding, R12 000. The factory uses 80% of the water and electricity.

- Rent expense is distributed according to floor space used. The factory occupies 7 200 m2 of the total floor space of 9 000 m2.

1.3. EASY FOODS

Easy Foods manufactures snack bars. The financial year ends on 31 December.

REQUIRED:

1.3.1. Explain why the change in units produced affected the fixed costs per unit. (2)

1.3.2. Give TWO possible reasons for the increase in direct material cost per unit. (4)

1.3.3. Explain why the business should not be satisfied with the level of production and the break-even point. Compare and quote figures for both years. (6)

1.3.4. The owner, Mike, wants to reduce the weight of the snack bars from 80 grams to 75 grams while keeping the selling price at R12,50 each.

Explain ONE reason against this option. (2)

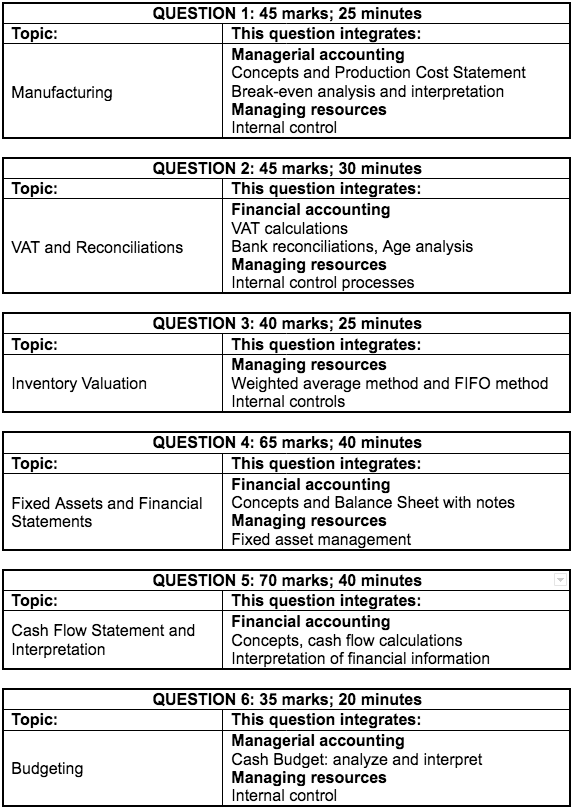

INFORMATION:

QUESTION 2: VAT AND RECONCILIATIONS (45 marks; 30 minutes)

2.1. VAT

The following relates to Lunga Stores for the VAT period ended 30 April 2020. VAT at 15% applies to all goods.

REQUIRED:

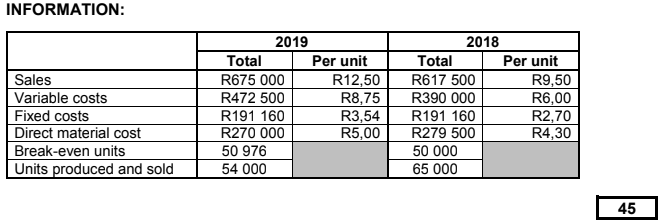

Calculate the VAT amounts denoted by (i) to (iii) on the table. Indicate the effect of EACH answer on the amount payable to SARS. Refer to the example. (8)

INFORMATION:

A. Amount owed to SARS on 1 April 2020, R5 500

B. Amounts from April 2020 Journals:

2.2. BANK RECONCILIATION AND INTERNAL CONTROL

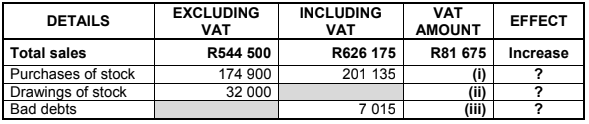

The information relates to Plaston Traders for April 2020. REQUIRED:

2.2.1. Show the entries that must be recorded in the Cash Journals. (10)

2.2.2. Calculate the Bank Account balance on 30 April 2020. (4)

2.2.3. Prepare the Bank Reconciliation Statement on 30 April 2020. (9)

2.2.4. As internal auditor you are not happy with the control of cash in this business.

- Explain TWO problems to confirm your suspicion. Quote figures.

- Give advice on how EACH problem can be avoided in future. (6)

INFORMATION:

A. Information from the Bank Reconciliation Statement on 31 March 2020:

- The deposit of R50 400 appeared on the Bank Statement on 14 April 2020.

- Cheque 960, issued in March 2020, was reflected on the Bank Statement for April 2020 as R14 550. The Bank Statement is correct.

B. Provisional totals in the Cash Journals on 30 April 2020 before receiving the April Bank Statement:

- Cash Receipts Journal, R65 570

- Cash Payments Journal, R64 790

C. Information on the April 2020 Bank Statement which did not appear in the April 2020 Cash Journals:

| DATE | DETAILS | DEBIT | CREDIT |

| 11 | ZL Nkosi (EFT by tenant) | R31 350 | |

| 25 | Debit order (Quick Insurance) | R9 750 | |

| 25 | Unpaid cheque (P Grobler) | 3 375 | |

| 28 | Interest | 150 | |

| 29 | Service fees | 600 | |

| 30 | Service fees | 600 |

NOTE: The bank duplicated the service fees in error. They will correct this error next month.

D. Deposit entries in the April 2020 Cash Receipts Journal that do not agree with the April 2020 Bank Statement:

- R27 750 on 24 April 2020

- R44 000 on 26 April 2020. The Bank Statement reflected this as R33 500. An investigation revealed that the cash slips added up to R44 000, but only R33 500 was deposited. The shortfall cannot be traced and must be written off.

E. Entries in the April 2020 Cash Payments Journal, not in the April 2020 Bank Statement:

| DOCUMENTS | DATE | DETAILS | BANK |

| Cheque 980 | 29 | PNA Suppliers | R8 600 |

| EFT: P Sithole | 30 | Drawings | R7 300 |

F. Bank Statement balance on 30 April 2020: …?

2.3. DEBTORS’ AGE ANALYSIS

The information relates to Tonga Hardware.

REQUIRED:

2.3.1. Explain how the Debtors’ Age Analysis will assist the business in managing debtors more effectively. (2)

2.3.2. Explain TWO separate problems highlighted by the age analysis. Provide evidence for EACH. (4)

2.3.3. State TWO strategies that Tonga Hardware can use to ensure that only reliable applicants are granted credit. (2)

INFORMATION:

A. Debtors are granted 30 days to settle their accounts.

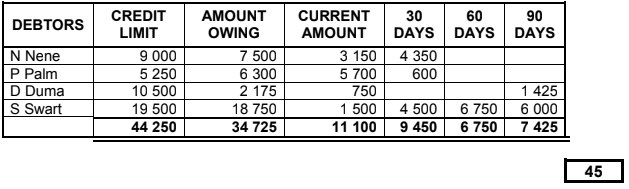

B. Debtors’ age analysis on 29 February 2020:

QUESTION 3: INVENTORY VALUATION (40 marks; 25 minutes)

3.1. Complete the sentences by filling in the correct stock valuation method. Write only the answer next to the question numbers (3.1.1 to 3.1.3) in the ANSWER BOOK.

3.1.1. The … method assumes that stock is sold in order of date purchased.

3.1.2. The … method divides the total cost of goods available for sale by the number of units.

3.1.3. The … method is used for very expensive, individually recognisable items.

(3 x 1) (3)

3.2. JJ FASHION HOUSE

JJ Fashion House uses the periodic stock system. Janine Naidoo owns the business.

REQUIRED:

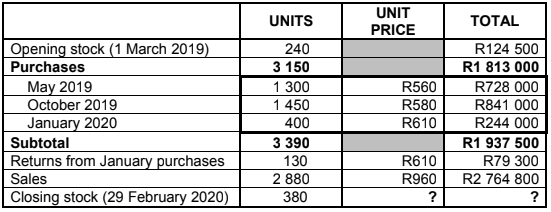

Refer to Information A: Jeans

3.2.1. Calculate the following on 29 February 2020:

- Value of the closing stock using the weighted-average method (6)

- Gross profit (4)

3.2.2. Calculate how long (in days) it will take to sell the closing stock of the jeans. (4)

3.2.3. Janine is considering a change in the method of valuing stock.

- Calculate the value of closing stock using the FIFO method. (7)

- State ONE advantage of using the FIFO method. (2)

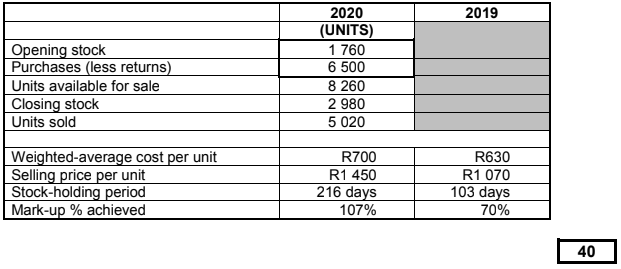

Refer to Information B: Jackets

3.2.4. The owner is concerned about the theft.

- Calculate the number of jackets stolen. (4)

- Give TWO solutions to solve the problem. (4)

3.2.5. The internal auditor is concerned about the stock levels and the selling price of jackets.

Explain reasons for his concern, with figures, and give different advice in EACH case. (6)

INFORMATION:

A. Jeans:

B. Jackets:

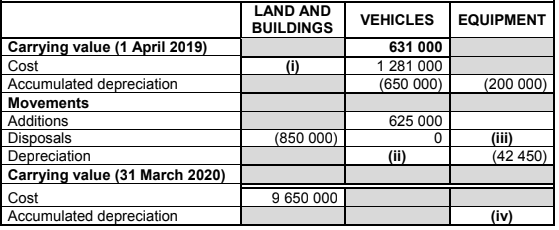

QUESTION 4: FIXED ASSETS AND FINANCIAL STATEMENTS (65 marks; 40 minutes)

AVENGERS LTD

The information relates to the financial year ended 31 March 2020.

REQUIRED:

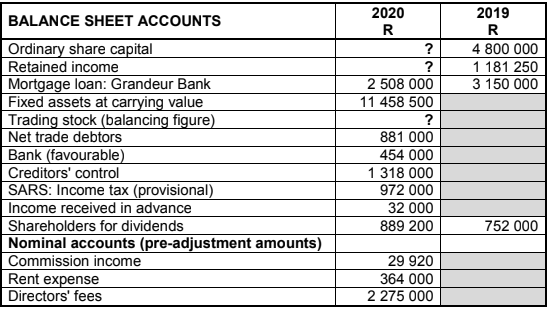

4.1. Refer to Information B.

Calculate the missing amounts denoted by (i) to (iv). (16)

4.2. Prepare the following notes to the Balance Sheet on 31 March 2020:

- Ordinary share capital (7)

- Retained income (8)

4.3. Complete the Balance Sheet (Statement of Financial Position) on 31 March 2020. Show workings. (34)

INFORMATION:

A. Amounts extracted from the books on 31 March:

B. Incomplete Fixed Asset Note:

Land and buildings:

- A building, on a separate property, was sold at cost.

Vehicles:

- A new vehicle was bought on 1 January 2020.

- Vehicles are depreciated at 20% p.a. on cost.

Equipment:

- Old equipment, cost R21 000, was sold on 30 September 2019. The accumulated depreciation was R15 000 on 1 April 2019.

- Equipment is depreciated at 15% p.a. on the diminishing-balance method.

C. Share capital:

| DATE | INFORMATION |

| 1 April 2019 | 800 000 ordinary shares in issue |

| 31 May 2019 | 400 000 ordinary shares issued |

| 1 October 2019 | 60 000 ordinary shares repurchased

|

D. Dividends:

- An interim dividend of 124 cents was paid on 30 September 2019.

- Final dividends were declared, R889 200.

E. Mortgage loan: Grandeur Bank

- Fixed monthly repayments (including interest) have been made and correctly recorded.

- Interest of R258 000 has not been recorded by the business yet.

- The capital repayment will remain the same over the next financial year.

F. The decrease in the provision for bad debts, R2 500, was not recorded.

G. Commission income for March 2020, R41 900, was still outstanding.

H. The company has three directors who earn the same monthly directors’ fee. One director has not received his directors’ fee for March 2020 yet.

I. Rent for April 2020 has been paid. The rent was increased by 25% on 1 January 2020.

J. Net profit after tax and income tax:

- The correct net profit after tax after all adjustments is R2 534 400.

- Income tax is calculated at 28% of the net profit.

[65]

QUESTION 5: CASH FLOW STATEMENT AND INTERPRETATION (70 marks; 40 minutes)

5.1. Choose the correct word(s) from those given in brackets. Write only the word(s) next to the question numbers (5.1.1 to 5.1.4) in the ANSWER BOOK.

5.1.1. The (internal/external) auditor is appointed by shareholders to express an unbiased opinion of the financial statements of a company.

5.1.2. (Directors/Shareholders) are responsible for the management and running of the business.

5.1.3. The (Income Statement/Balance Sheet) shows the financial position of the business in terms of its assets, equity and liabilities.

5.1.4. The (Income Statement/Cash Flow Statement) is a financial statement that shows the sources of a company’s funds and how they were used.

(4 x 1) (4)

5.2. BOMBAY LTD

The information relates to Bombay Ltd for the financial year ended 29 February 2020.

REQUIRED:

5.2.1. Fill in the missing amounts on the Cash Flow Statement provided. Show workings. Indicate outflows in brackets. (22)

5.2.2. Calculate the following financial indicators on 29 February 2020:

- % operating profit on sales (3)

- Acid-test ratio

NOTE: The current ratio is 1,6 : 1. (5) - Net asset value (NAV) per share (5)

INFORMATION:

A. Extract from the Income Statement (Statement of Comprehensive Income) on 29 February 2020:

| Sales | R4 824 000 |

| Gross profit | 1 608 000 |

| Depreciation | 312 600 |

| Operating profit | 1 122 500 |

| Net profit before tax | 984 000 |

| Net profit after tax | 688 800 |

B. Extract from the Balance Sheet (Statement of Financial Position) on 29 February:

2020 | 2019 | |

| Fixed assets (carrying value) | 4 830 000 | 3 760 100 |

| Current assets | ? | 962 000 |

| Current liabilities | 774 000 | 712 800 |

| Trading stock | 619 000 | 538 000 |

| Bank | 0 | 56 400 |

| Petty cash | 2 500 | 0 |

| Ordinary share capital | 5 880 000 | 5 360 000 |

| Retained income | 542 800 | 236 000 |

| Loan: Kan Bank | 950 000 | 1 300 000 |

| SARS: Income tax | 26 400 (Cr) | 11 600 (Dr) |

| Shareholders for dividends | 165 000 | 126 000 |

| Bank overdraft | 28 800 | 0 |

C. Share capital and dividends:

- The authorised share capital comprises 1 500 000 shares.

- On 1 March 2019, 60% of the authorised shares were in issue.

- On 30 June 2019, 200 000 additional shares were issued for R1 240 000.

- On 29 February 2020, 120 000 shares were repurchased at R96 000 above the average share price.

- Total dividends paid and declared in the 2020 tax year were R286 000.

D. Fixed assets:

- Additions to buildings were completed during November 2018.

- Old equipment was sold at carrying value, R34 500.

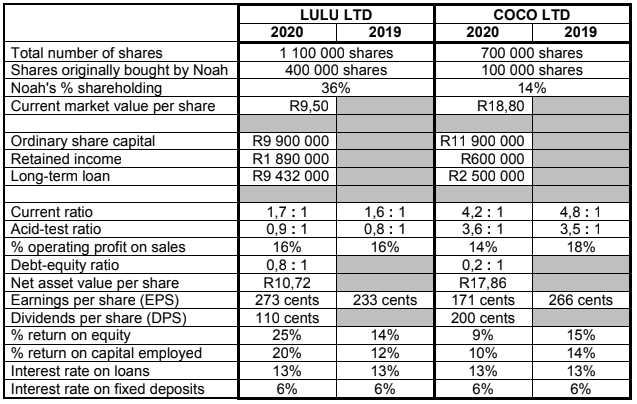

5.3. TWO COMPANIES: LULU LTD AND COCO LTD

Noah Lott won R5,6 m in the national lottery five years ago and then decided to invest R2,8 m in each of the two companies below, as follows:

| Lulu Ltd | 400 000 shares at R7,00 each = R2,8 m |

| Coco Ltd | 100 000 shares at R28,00 each = R2,8 m |

He wants your opinion on these companies.

NOTE: When answering the questions below, compare the information given and quote the relevant financial indicators of both companies (percentages, ratios and/or amounts).

INFORMATION:

REQUIRED:

5.3.1. Explain which company has the better liquidity. Quote TWO financial indicators to support your opinion. (4)

5.3.2. Comment on the earnings per share and the % return on equity of Lulu Ltd. Give TWO reasons why the shareholders will be satisfied with these indicators. (5)

5.3.3. Comment on the market value of the shares in Coco Ltd. Explain TWO points. (4)

5.3.4. Compare the dividend payout rates of both companies and explain why the directors of EACH company decided on these payout rates. (4)

5.3.5. Noah says that the dividend of 110 cents per share he earned from Lulu Ltd is better than the dividend of 200 cents per share from Coco Ltd. Give ONE point to prove that he is incorrect. (4)

5.3.6. Comment on the risk and gearing of EACH company. Quote TWO financial indicators. (6)

5.3.7. Noah wants to buy shares in Lulu Ltd on the JSE at current market value to become the majority shareholder and CEO. Calculate how much Noah will have to pay for the shares that he needs. (4)

[70]

QUESTION 6: BUDGETING (35 marks; 20 minutes)

6.1. Indicate whether the following statements are TRUE or FALSE. Write only ‘true’ or ‘false’ next to the question numbers (6.1.1 to 6.1.3) in the ANSWER BOOK.

6.1.1. Bad debts is an example of a payment in a Cash Budget.

6.1.2. A Projected Income Statement estimates the expected profit or loss for a specified period.

6.1.3. A decrease in a fixed deposit will be shown as a receipt in the Cash Budget.

(3 x 1) (3)

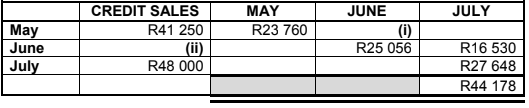

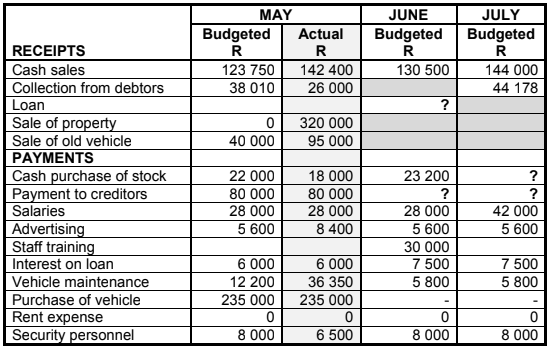

6.2. KURUMAN (PTY) LTD

John Peters is the majority shareholder and CEO. You are provided with information for the period ending 31 July 2020. There are five other shareholders.

Refer to Information A.

6.2.1.

- Calculate the missing amounts indicated by (i) and (ii) in the Debtors’ Collection Schedule. (4)

- Calculate the percentage discount allowed to debtors who settle in the month of the sales transactions. (5)

6.2.2. Calculate the following budgeted amounts:

- Total sales for July 2020 (3)

- Payment to creditors during June 2020 (4)

- Additional loan to be acquired on 1 June 2020 (4)

6.2.3. The directors did not adhere to the Cash Budget during May 2020.

- Identify TWO overpayments in May 2020. Provide figures.

- Give a valid reason for EACH overpayment identified, to support their decisions. (6)

Refer to Information E.

6.2.4. Why are the auditors concerned that the agreement with Tradecor is unethical or possibly a crime? Explain THREE points. (6)

INFORMATION:

A. Sales and debtors’ collection:

- Estimates of total sales for 2020:

| April | R150 000 |

| May | R165 000 |

| June | ? |

- 25% of all sales are on credit. The rest is for cash.

- Debtors are expected to settle as follows:

- 60% within the same month of sale, subject to a cash discount allowed.

- 38% in the month following the month of sale.

- 2% of debts are written off in the second month following the month of sale.

- Partially completed Debtors’ Collection Schedule:

B. Purchases of merchandise and payments to creditors:

- The business uses a fixed-stock base with stock sold being replaced monthly.

- The business uses a mark-up of 50% on cost.

- 20% of all merchandise is purchased for cash.

- Creditors are paid in full in the month following the month of purchase.

C. Loan and interest:

The loan from Bokke Bank will be increased on 1 June 2020. Interest at 20% p.a. is not capitalized and is payable at the end of each month.

D. Extract from the Cash Budget for the three months ending 31 July 2020:

E. Agreement with Tradecor:

The CEO, John Peters, decided to sell one of the company’s properties at book value. This property was originally bought for R320 000 in 1980. According to the sale agreement, the purchaser, Tradecor, would rent the property back to Kuruman (Pty) Ltd for R26 000 per month with effect from 1 June 2020.

The auditors of Kuruman (Pty) Ltd discovered that the sole owner of Tradecor is John Peters’s wife. They regard this agreement as unethical and possibly a crime.

[35]

TOTAL: 300