At Matric College, we try to give our students the best, most relevant and up-to-date information with regard to any of our courses.

ICB is one of the many courses that we offer at Matric College. Students that want to start their career with a Business or Management course should apply for an ICB course. In this article, you will learn everything you need to know about ICB.

Are ICB Qualifications Recognised?

Yes, ICB Qualifications are recognised by employers nationally and internationally. Here is a list of the internationally recognised professional bodies:

- Association of Chartered Certified Accountants (ACCA)

- Chartered Institute of Management Accountants (CIMA)

- International Association of Bookkeepers (IAB)

- International Association of Accounting Professionals (IAAP)

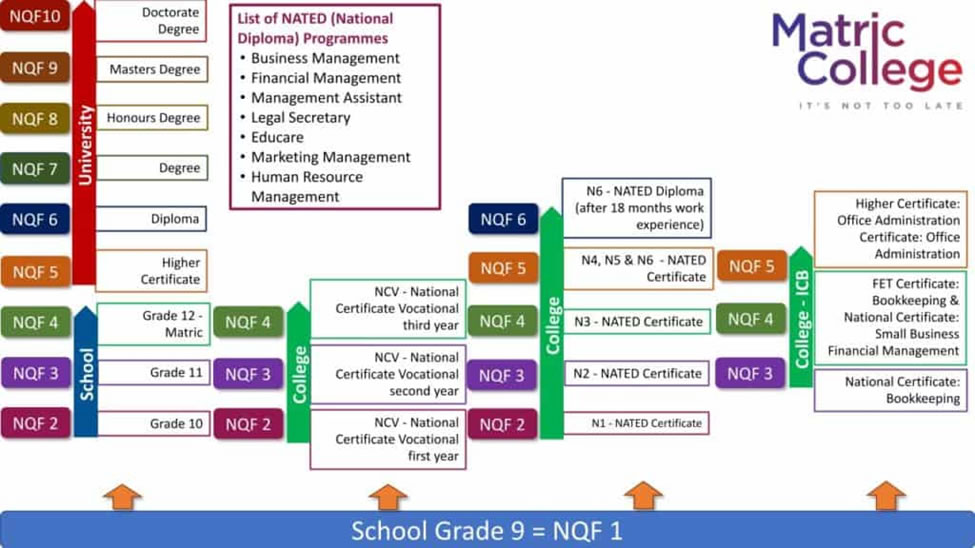

ICB Qualifications are also on the National Qualifications Framework (NQF) system. This system ensures that all qualifications in South Africa meet a certain standard and quality.

Students can identify where they are at on the NQF system, and it allows employers to identify how many skills and knowledge students possess.

What Are The NQF Levels In South Africa?

The NQF Levels are explained in the image below:

What NQF Level Is Matric?

Matric is at NQF Level 4. If you would like to improve your Matric marks or complete Matric you can apply for the following Matric Courses:

- Adult Matric

- This course is for students that want to complete Matric as adults. Here are the entry requirements:

- Have a Grade 9 Certificate or

- ABET Level 4

- Be at least 21 years old to apply for this course. You can apply if you are only 19 years old, but you have to be 21 when you write the Matric exam.

- Study through distance learning

- Understand, read and write in English or Afrikaans

- This course is for students that want to complete Matric as adults. Here are the entry requirements:

- Matric Upgrade

- This course is for students who have failed Matric or that need to improve their Matric marks to gain admission to a university. Here are the entry requirements for this course:

- Must already have completed Matric

- Understand, read and write English

- Study through distance learning

- This course is for students who have failed Matric or that need to improve their Matric marks to gain admission to a university. Here are the entry requirements for this course:

Is ICB SAQA Accredited?

Yes, ICB is SAQA (South African Qualifications Authority) accredited. All ICB’s courses have SAQA ID numbers that can be identified on the SAQA website. SAQA oversee the NQF system and makes sure that all qualifications meet the standards necessary.

What Is An ICB Qualification?

An ICB Qualification is what a student will get awarded after they have completed an ICB Course or ICB Programme. These qualifications can be one of the following:

| ICB Qualification | NQF Level | Credits |

| ICB National Certificate | NQF Level 3 or NQF Level 4 | 120 – 130 credits |

| ICB Further Education and Training Certificate | NQF Level 4 | 130 credits |

| ICB Higher Certificate | NQF Level 5 | 120 – 240 credits |

| ICB National Diploma | NQF Level 5 or NQF Level 6 | 251 – 360 credits |

What Can You Do With An ICB Qualification?

Once you have achieved your ICB Qualification, your options are endless. Keep in mind, that each qualification opens up different career opportunities. The more you study, the higher your chances of getting employed, and you will earn more money.

You will also gain more job opportunities with higher levels of qualifications. Here are some of the main things you can do with your ICB Qualification:

- You can look for entry-level employment opportunities

- For example, if you complete an Office Administration: ICB National Diploma you can find the following job opportunities:

- Administrative Assistant Manager

- Office Assistant Manager

- Learnerships

- Internships

- Part-time jobs

- For example, if you complete an Office Administration: ICB National Diploma you can find the following job opportunities:

- You can further your studies in the same ICB Programme

- For example, if you complete an Office Administration: ICB National Certificate, you can further your studies and complete the Office Administration: ICB Higher Certificate and then complete the Office Administration: ICB National Diploma

- For example, if you complete an Office Administration: ICB National Certificate, you can further your studies and complete the Office Administration: ICB Higher Certificate and then complete the Office Administration: ICB National Diploma

- You can further your studies with another ICB Programme

- For example, if you have completed the entire ICB Office Administration Programme, you can complete another ICB Programme like the ICB Business Management Programme.

ICB does apply Recognition of Prior Learning (RPL) to their courses, which means that you will not have to repeat the same subjects.

Find below an example, of a student completing the Office Administration: ICB National Certificate and then completing a Small Business Financial Management: ICB National Certificate afterwards.

| Office Administration: ICB National Certificate | Small Business Financial Management: ICB National Certificate |

| Bookkeeping and Office Administration | Business Management 1 |

| Bookkeeping to Trial Balance | Bookkeeping to Trial Balance |

| Business Literacy | Business Literacy |

| Business Law and Administrative Practice | |

| Cost and Management Accounting | |

| Marketing Management and Public Relations |

As seen in the table above, if you complete the Office Administration: ICB National Certificate and move to the Small Business Financial Management: ICB National Certificate you only have to complete (1) one subject which is the Business Management 1 subject. This means that you only have to complete one subject to gain another ICB Qualification.

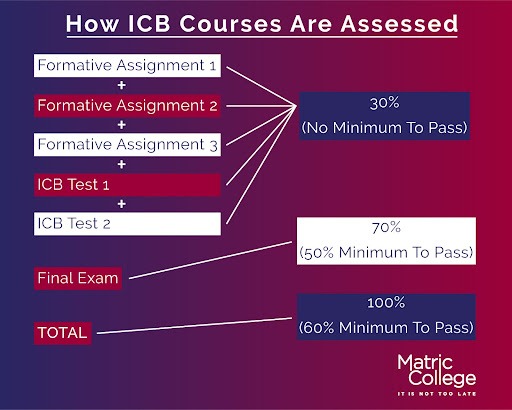

How Will I Be Assessed In An ICB Course?

You will be assessed through the Portfolio of Evidence as well as the final exam. The PoE will consist of the following:

- Assignments

- Open-book tests

- Administrative Guide

- Answer Books

You must get at least 50% for each assignment and open book test to qualify for the final exam. Here are the two ways you can write the final exam:

- Online Exam

- Paper-based Exam

You must get 60% in total to pass the subject. This means that you will get a PoE for each subject that you receive. Here is an image of how you will be assessed:

How Hard Is The Certified Bookkeeper Exam?

This exam is hard because of the standards that these courses keep up with. If you are dedicated, passionate and interested in these courses then it will still be challenging, but this comes with any course that you complete.

What Should I Study After ICB?

This depends on you as the student. If you do not want to continue your studies with ICB, you can complete any of the following NATED Courses:

- Business Management

- Educare

- Financial Management

- Human Resource Management

- Management Assistant

- Marketing Management

NOTE:

You can study our NATED Courses with a Matric Certificate, National Senior Certificate or an Amended Senior Certificate.

ALSO, NOTE:

You can apply with any Matric Pass Level.

Why Should I Study At Matric College?

You should study at Matric College for the following reasons:

- You can work and study if you choose to study at Matric College. This allows you to continue earning a salary.

- You can register with us any time of the year. This means that you can save up before you choose to study with us, and you can make a decision in your own time.

- Study at your own pace. You can inform ICB when you are ready to write the final exam and then only will they send you the relevant information.

- Make a payment that suits your financial situation. Here are the different payment options:

- Monthly payment

- Split payment

- Monthly payment

- Unique payment

- Speak to a Course Expert in the language of your choice. Our Course Experts can speak up to 11 languages combined.

What Is The Purpose Of ICB?

The purpose of ICB is to provide accredited and recognised qualifications to students that want to complete a business or management course. These courses are completed with or without Matric. Here are the (3) ICB Programmes with their entry requirements:

- ICB Business Management

- Start your first course with a Grade 11 Certificate or

- Grade 11 Equivalent (NQF Level 3)

- Or our Bookkeeping: ICB National Certificate

- ICB Financial Accounting

- Start your first course with a Grade 10 Certificate

- Or Grade 10 Equivalent Certificate (NQF Level 2)

- ICB Office Administration

- Start your first course with a Grade 12 Certificate or

- Grade 12 Equivalent Certificate (NQF Level 4)

- Or our Bookkeeping: ICB FET National Certificate

Or our Small Business Financial Management: ICB National Certificate

Why Should I Study An ICB Course?

You should study an ICB Course for the following reasons:

- It is a scarce skill qualification

- You can study with or without Matric

- You get RPL if you study with ICB

- Study an accredited and recognised qualification

- Work abroad

- Earn a decent salary

- Increase your chances of finding employment

Take the opportunity to become a business professional with any of our ICB Courses.

Author: Jesmé Africa

Editor: Amy Venter

Date Published: May 26, 2022